Many freelancers find themselves spending long hours doing their accounting by hand but aren’t sure if it’s worth the cost to spring for accounting software. Fortunately, there are many affordable accounting software for freelancers available, including some forever free options.

In this shopping guide, we’ve rounded up the six best accounting software for freelancers of all kinds.

Top accounting software for freelancers comparison

Besides pricing, there are many different features to consider when trying to decide on the best accounting software for freelancers with your needs.

| Starting price | Forever free plan | Expense tracking | Native time tracking | Inventory management | ||

|---|---|---|---|---|---|---|

| FreshBooks | $19/mo. | No | Yes | Yes | Yes | Try FreshBooks |

| Xero | $15/mo. | No | Yes | Yes | Yes | Try Xero |

| Wave Accounting | $0/mo. | Yes | Yes | No | No | Try Wave |

| Zoho Books | $15/mo. | Yes | Requires integration with Zoho Expense | Yes | Yes | Try Zoho Books |

| QuickBooks Online | $30/mo. | No | Yes | Yes | Yes | Try QuickBooks |

| Sage 50 Accounting | $58.92/mo. | No | Yes | No | Yes | Try Sage |

FreshBooks: Best overall

Our star rating: 4.1 out of 5

FreshBooks is often billed as a more affordable alternative to QuickBooks, and it’s easy to see why: FreshBooks includes comparable features but starts at nearly half the cost. The more affordable entry-level plan will appeal to freelancers that just need basic accounting features, and the invoice creation tool is especially helpful for freelancers. Higher-tier plans include features like mobile receipt capture, recurring billing and accountant access.

Pricing

- Lite: $19 per month billed monthly or $204 billed yearly. Allows users to bill five clients per month.

- Plus: $33 per month billed monthly or $360 billed yearly. Allows users to bill 50 clients per month.

- Premium: $60 per month billed monthly or $660 billed yearly. Includes unlimited billable clients.

- Select: Custom quote pricing for enterprises.

Features

- Easy invoice creation tool.

- Convert estimates and proposals to invoices.

- Expense tracking and mobile receipt capture.

- Native time and expense tracking.

Pros

- Transparent, affordable pricing plans.

- Payroll integration with Gusto and SurePayroll.

- Intuitive, user-friendly interface.

- Highly rated mobile apps.

Cons

- Charges $11 per month for additional users.

- Charges $20 per month for Advanced Payments feature.

- Only 5 clients are allowed on the Lite plan.

- Could use more third-party integrations.

For more information, read the full FreshBooks review.

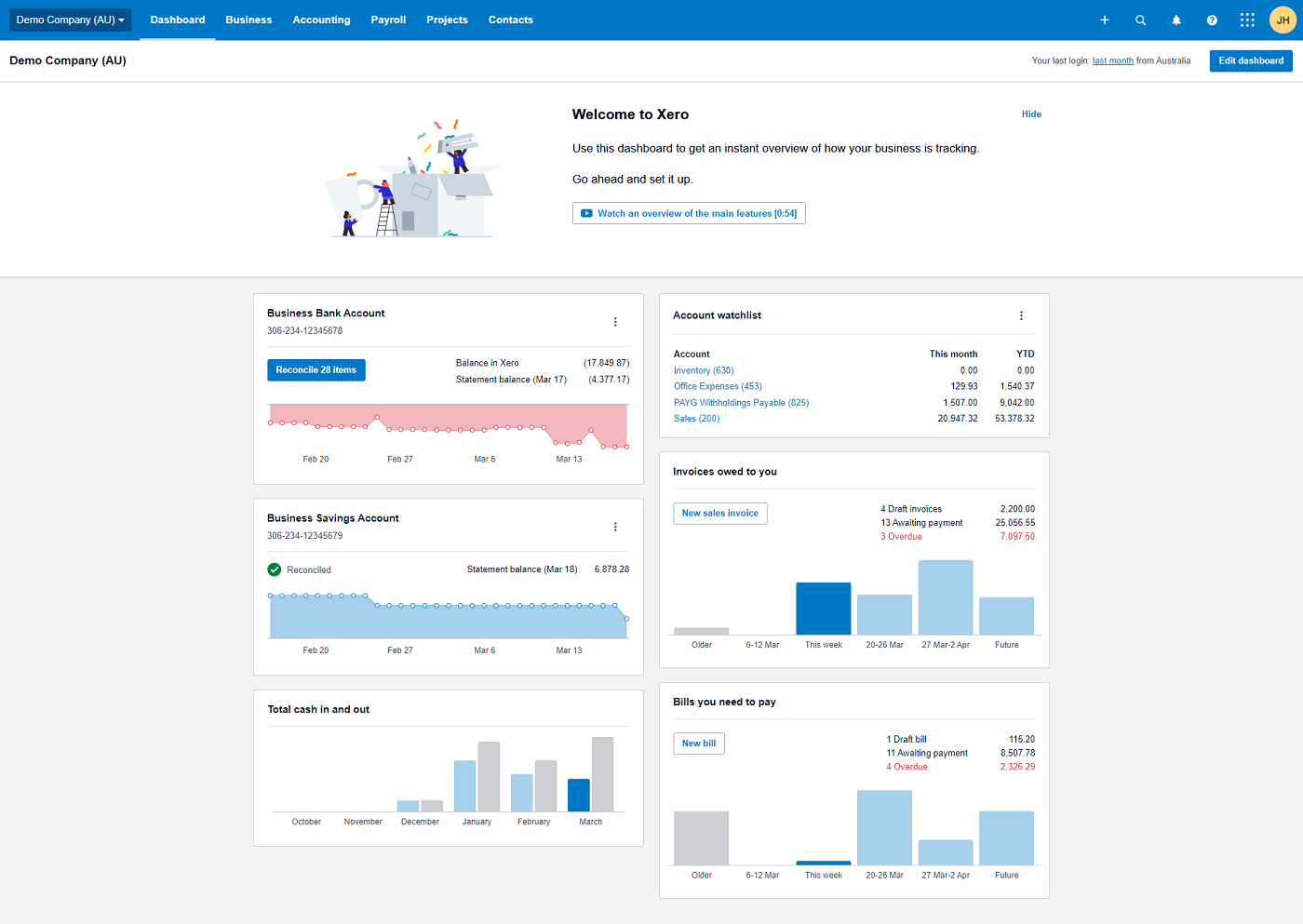

Xero: Best for product-based businesses

Our star rating: 4.4 out of 5

Xero Accounting’s cloud-based double-entry accounting software features native inventory management features, making it a great choice for product-based businesses. Not only can you keep track of your stock levels and see what’s selling, Xero will also automatically populate invoices and orders with items you sell. Xero’s pricing plans are also affordable, which will appeal to solo operations that won’t break the bank.

Pricing

- Early: $15 per month.

- Growing: $42 per month.

- Established: $78 per month.

Features

- Track inventory and create orders.

- Generate financial and accounting reports.

- Connect to multiple payment gateways and financial institutions.

- Mobile app for expense management.

Pros

- Unlimited users on all plans.

- Guided setup process.

- Payroll integration with Gusto available.

- Project and time tracking included in some plans.

Cons

- Early plan limited to 20 invoices and 5 bills per month.

- Only one organization allowed per account.

- Multiple features limited to the most expensive Established plan.

- No telephone support offered.

For more information, read the full Xero review.

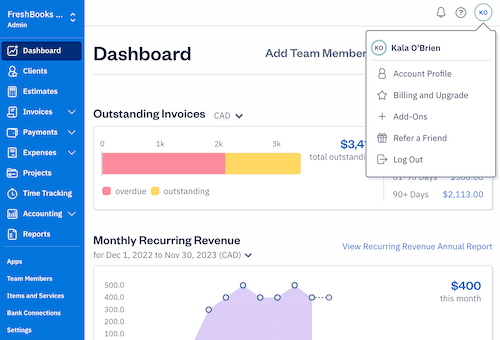

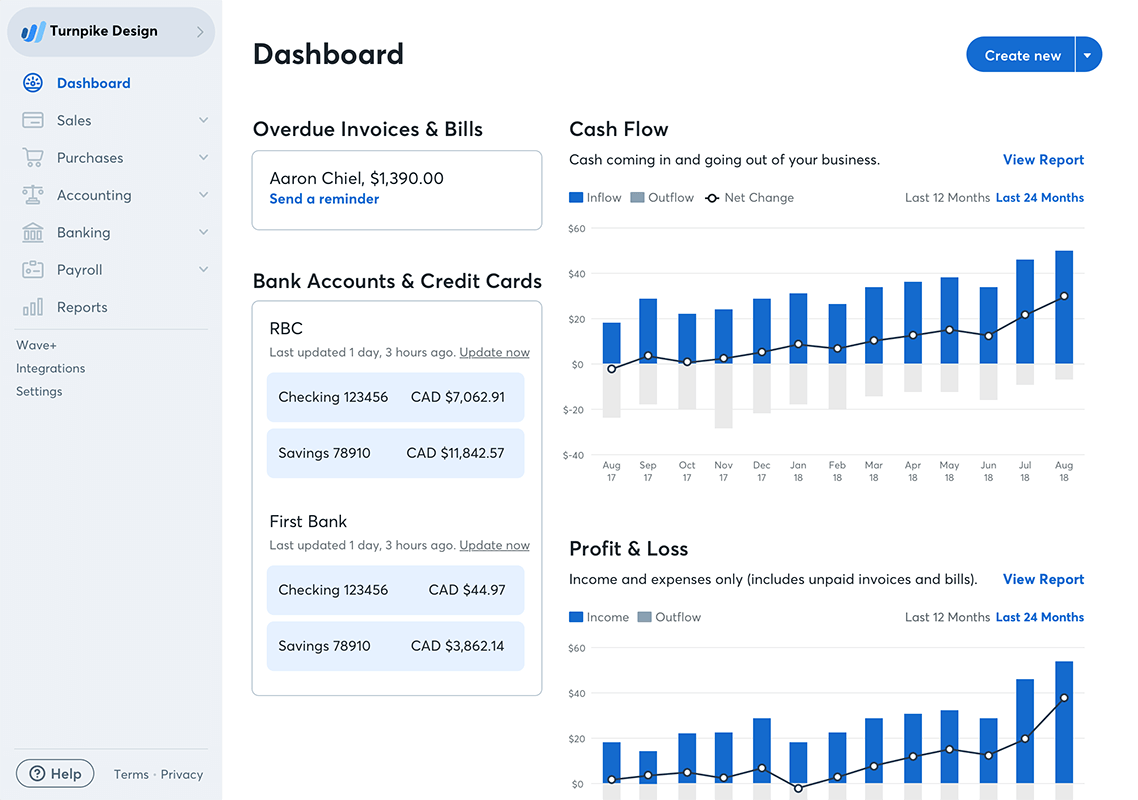

Wave Accounting: Cheapest option

Our star rating; 4 out of 5

If you’re on a serious budget, try Wave’s free accounting and invoicing plan. For the most part, the platform makes money through standard payment fees and add-ons like mobile receipts and payroll, although these services aren’t mandatory if you want to use the accounting and invoicing features. Each Wave account comes with unlimited invoices, clients, bank accounts and credit connections — all absolutely free.

But if you need more than the basic features you can get with Wave’s free plan, you can upgrade to Wave Pro, which costs $16 per month. Wave’s paid plan offers more expansive features at a below-average starting price, unlimited receipt scanning and unlimited users included.

Pricing

- Wave Starter: Free forever.

- Wave Pro: $16 when billed month to month or $170 when billed once per year.

- Credit card payments: 2.9% (or 3.4% for AMEX) + $0.60 per transaction. (Price may be reduced with Wave Pro depending on promotion.)

- Bank payments: 1% per transaction.

- Mobile receipts: Free with Wave Pro or $11 a month or $96 a year when included as an add-on with Wave Starter.

- Payroll: $40 a month in tax service states and $20 a month in self-service states, plus $6 per active employee or independent contractor paid each month.

- Advisors: $149 a month for ongoing bookkeeping support, or $379 for a one-time accounting and payroll coaching package.

Features

- Create invoices and set up recurring billing.

- Basic accounting reports included.

- Built-in payment processing.

- Native payroll add-on available.

Pros

- Completely free accounting and invoicing plan.

- Unlimited clients, invoices and bank accounts.

- Interface is simple to navigate.

- Can manage multiple businesses in one accounting software.

Cons

- Free plan users must pay for mobile receipt capture.

- No built-in integrations.

- Not as many accounting features as QuickBooks and other competitors.

- Customer support not included with free plan and available through email and chat only with paid plan.

For more information, read the full Wave Accounting review.

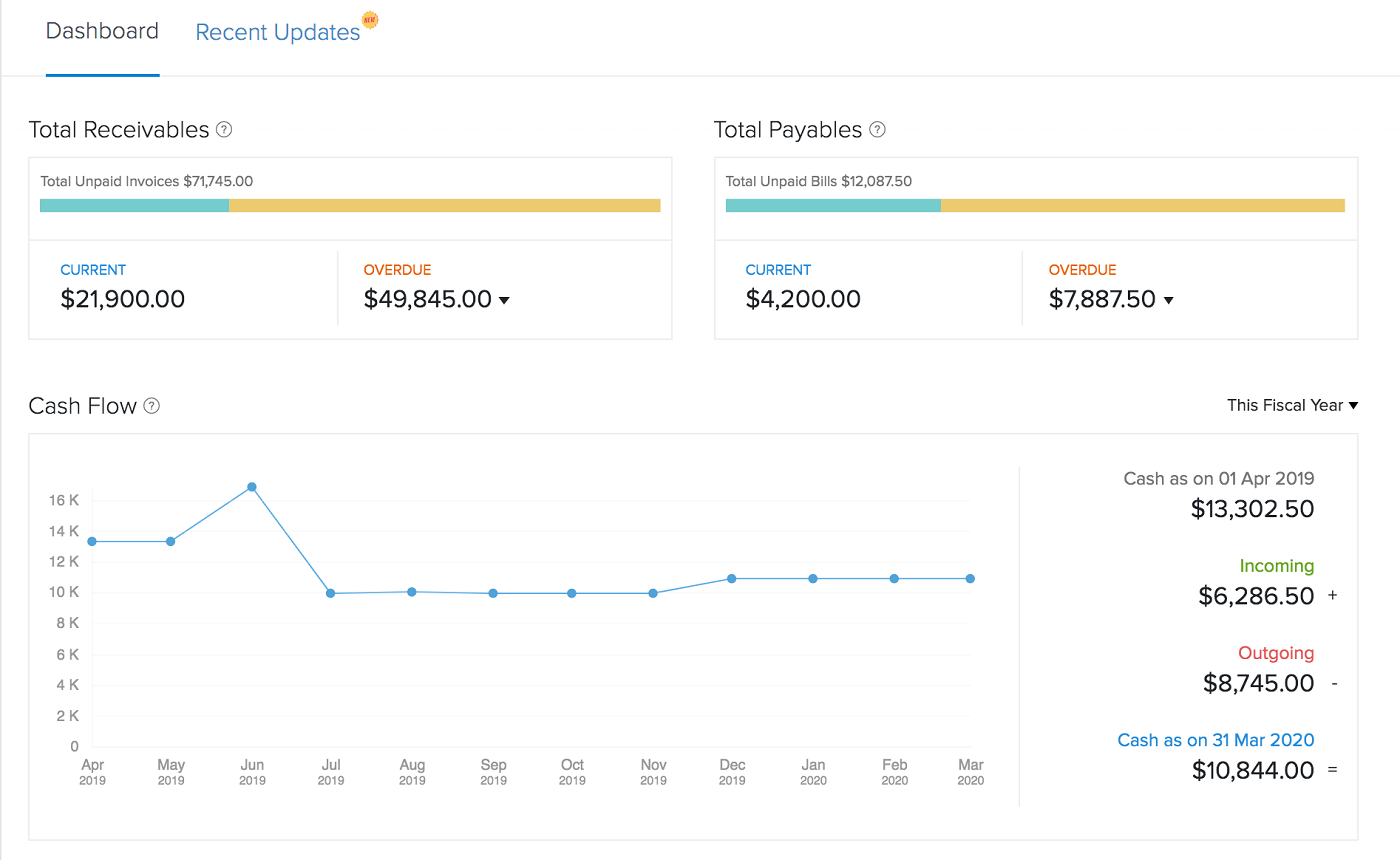

Zoho Books: Most fully featured

Our star rating: 4.7 out of 5

Zoho Books offers a comprehensive selection of accounting features combined with six different transparent pricing plans that offer lots of scalability. While the entry-level plans offer pretty basic features, the more expensive plans get way more advanced with tools for sales approvals, workflow rules, inventory controls, advanced analytics and more. Zoho Books also integrates with Zoho’s dozens of business apps, making it possible to build an entire Zoho software stack.

Pricing

- Free: $0 for businesses with less than $50K USD per calendar year.

- Standard: $15 per organization per month billed annually, or $20 per organization per month billed monthly.

- Professional: $40 per organization per month billed annually, or $50 per organization per month billed monthly.

- Premium: $60 per organization per month billed annually, or $70 per organization per month billed monthly. A 14-day free trial is available for this plan.

- Elite: $120 per organization per month billed annually, or $150 per organization per month billed monthly.

- Ultimate: $240 per organization per month billed annually, or $275 per organization per month billed monthly.

Zoho Books also offers the following add-ons:

- Additional users: $3 per user per month.

- Advanced auto scans: $10 per month for 50 scans per month.

- Snail mails: $2 per credit.

Features

- Custom invoice creator.

- Native time tracking included.

- Connects with many different payment gateways.

- Each plan includes accountant access.

Pros

- Free Zoho Books webinar every week.

- Six pricing plans offer excellent scalability.

- Integrates seamlessly with the entire Zoho software stack.

- Expense and mileage tracking supported on all plans.

Cons

- Charges a small fee for extra users.

- Email-only support for the free plan.

- Must upgrade to Professional plan for timesheet management.

- Can present a higher learning curve than some other options on this list.

For more information, read the full Zoho Books review.

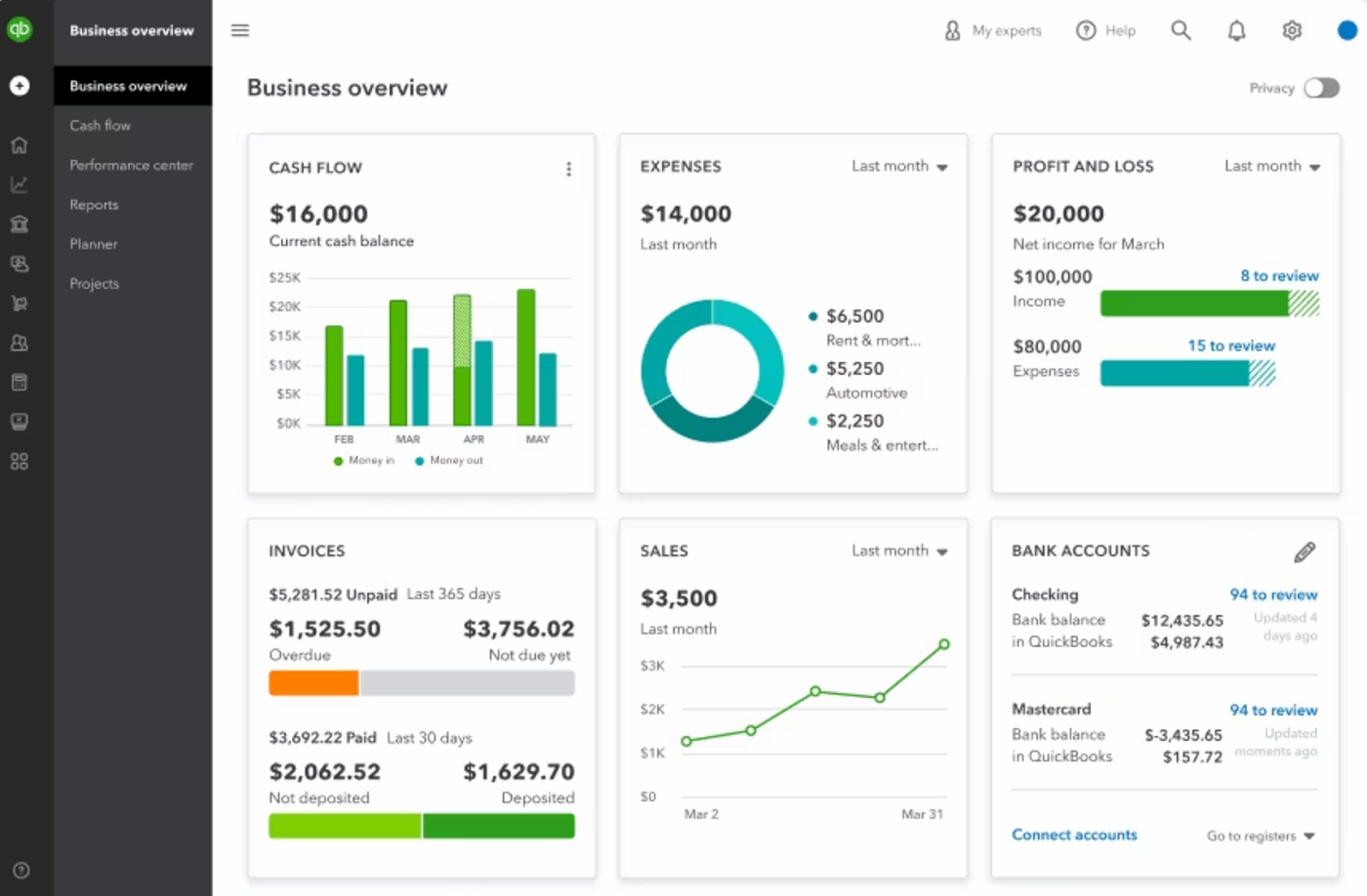

QuickBooks Self-Employed: Best tax tracking

Our star rating: 4.6 out of 5

QuickBooks offers some of the most advanced accounting features on the market, and many freelancers will greatly appreciate its tax preparation report. Even the most basic QuickBooks account includes invoice creation, payment acceptance, expense tracking, mileage tracking, cash flow forecasting and basic reports. However, its prices are above average compared to most other accounting software for small businesses, so not every freelancer will have a budget for it.

Pricing

- QuickBooks Simple Start: $30 per month with access for one user.

- QuickBooks Essentials: $60 per month with access for up to three users.

- QuickBooks Plus: $90 per month with access for up to five users.

- QuickBooks Advanced: $200 per month with access for up to 25 users.

Features

- Create invoices, estimates and quotes.

- Automatic income and expense tracking.

- Generic accounting and finance reports.

- Inventory management tools available.

Pros

- Comprehensive double-entry accounting features.

- Unlimited invoices, clients and bills on all plans.

- Familiar to accountants all over the world.

- Expense and mileage tracking on all plans.

Cons

- Customer service could be improved.

- Higher than average prices.

- Each plan limits the number of users.

- Must choose between a free trial and a discount on the first three months of service.

For more information, read the full QuickBooks Online review.

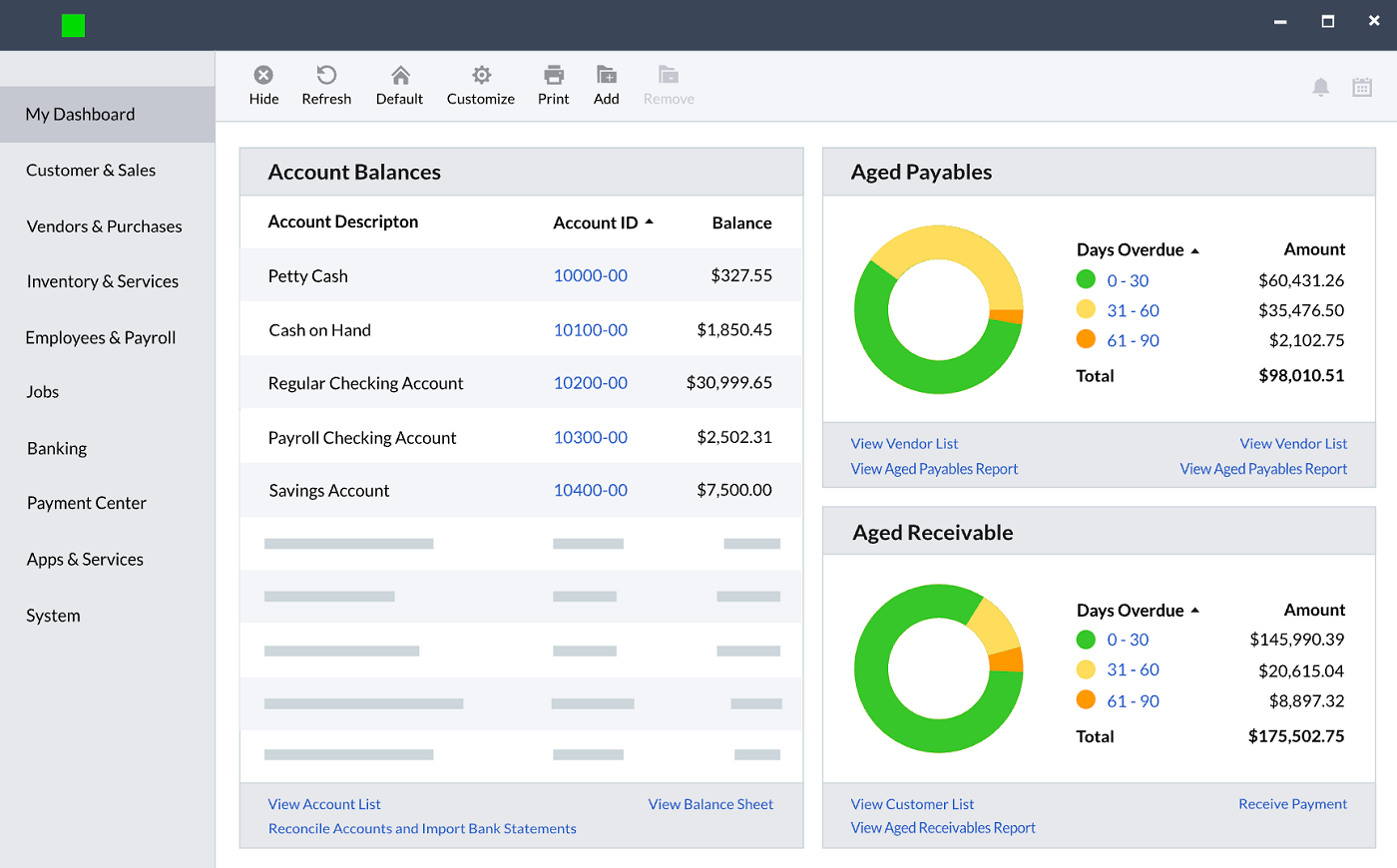

Sage 50 Accounting: Best support for growing businesses

Our star rating: 4.6 out of 5

While you might associate Sage with enterprise software, it also offers multiple tools targeted toward midsize businesses, including Sage 50 Accounting. Sage Accounting has an extensive knowledge base to help new business owners get up to speed on all things accounting. If you can’t figure things out on your own, then give the well-reviewed customer service department a call.

Pricing

- Sage Pro Accounting: Costs $58.92 per month or $595 per year for one user.

- Sage Premium Accounting: Costs $96.58 per month or $970 per year for one user.

- Sage Quantum Accounting: Costs $160 per month or $1,610 per year for one user.

Features

- Create quotes and invoices easily.

- Bill payment function.

- Great inventory tracking.

Pros

- Support multiple currencies.

- Extremely affordable pricing plans.

- Unlimited users on Sage Accounting plan.

- Extensive knowledge base available.

Cons

- Pricy starting prices.

- Large price increase for adding multiple users.

- Interface may seem outdated to some users.

For more information, read the full Sage Accounting review.

Key features of accounting software for freelancers

Invoicing

Many freelancers use invoices to charge their clients, making this an absolutely essential feature of any accounting software for freelancers. The software should allow users to choose from multiple email templates and customize them to their needs. It should also let users create a proposal or estimate, which they can then convert to an invoice after approval.

Time tracking

Time tracking is extremely helpful for any freelancer who charges their clients per billable hour or who has part-time employees that they pay by the hour. Some accounting software includes built-in time tracking, while others rely on integration with third-party tools for this feature. If you use a payroll platform, then the time tracking data should be easy to import into that as well.

Expense and mileage tracking

If you must track expenses and mileage so your clients can reimburse you later, then definitely look for accounting software that offers this feature. Some software confines this feature to more expensive plans or forces you to pay an extra fee for mobile receipt capture, so be sure to account for that in your budget.

Reporting

While freelancers’ accounting may be less complex than that of a large corporation, it’s still important for them to have a clear picture of the financial health of their business. That’s why you should look for accounting software for freelancers that generates reports automatically. The platform should also come preloaded with a selection of reporting templates to choose from.

Inventory tracking

Not all freelancers sell products, but if you do, then you definitely need inventory tracking to manage your stock levels to see what’s selling and what’s not. If you get accounting software with inventory tracking already included, that will make it extremely easy to generate invoices for each item sold and to log each transaction in your books.

How do I choose the best accounting software for freelancers for my business?

Many freelancers are on a tight budget, so it’s important to keep that top of mind when shopping for the best accounting software for freelancers. Fortunately, there are multiple budget-friendly picks, including some forever free options like Wave Accounting. Each platform takes a different approach to what features are included in each pricing tier, so get specific about your must-haves since that can have a big impact on your budget.

Most accounting software for freelancers offers free trials, and those that don’t encourage you to schedule a demo call with the sales team. Take your time testing out each software to see if it meets your needs and if you can do without the features on the most expensive plans. If you’re still not fully sold by the time your free trial ends, try a month-to-month subscription first so you’re not locked into an annual contract with an accounting software that might not meet your needs.

Methodology

To choose the best accounting software for freelancers, we consulted user reviews and product documentation. We considered factors such as pricing, customer support and user reviews. We also considered features such as invoicing, time tracking, expense tracking, mileage tracking, inventory tracking and financial reports.

Source of Article