Looking for the best financial forecasting software? Explore the key features to consider when choosing the right solution for your business.

Financial forecasting is an essential step of many business activities, from creating a financial plan to establishing a budget for the upcoming fiscal year. However, calculating financial forecasts by hand is time consuming and prone to error — but financial forecasting software can cut out much of the manual work. In this guide, we explain how to choose financial forecasting software and what features to look for in financial forecasting software.

Jump to:

Featured Partners: Finance Software

What is financial forecasting?

Financial forecasting involves analyzing an organization’s past and current financial performance to predict future financial performance. Financial forecasting is essential for making evidence-based business decisions instead of basing recommendations purely on conjecture.

There are many different financial forecasting techniques that businesses can use. The four main methods are straight line forecasting, moving average forecasting, simple linear regression forecasting and multiple linear regression forecasting. The best financial forecasting software will include all of these quantitative techniques, so you can compare them to each other and choose the best one for each specific scenario.

How to choose the best financial forecasting software

Consider your holistic software needs

You can get standalone financial forecasting software, such as Anaplan. However, some businesses prefer to choose more versatile software that includes financial forecasting as well as other features. For instance, large enterprises use dedicated ERP software like Workday for multiple types of forecasting, including financial forecasting. Consider your overall software stack and what needs you have to narrow down the exact type of software that you’re looking for.

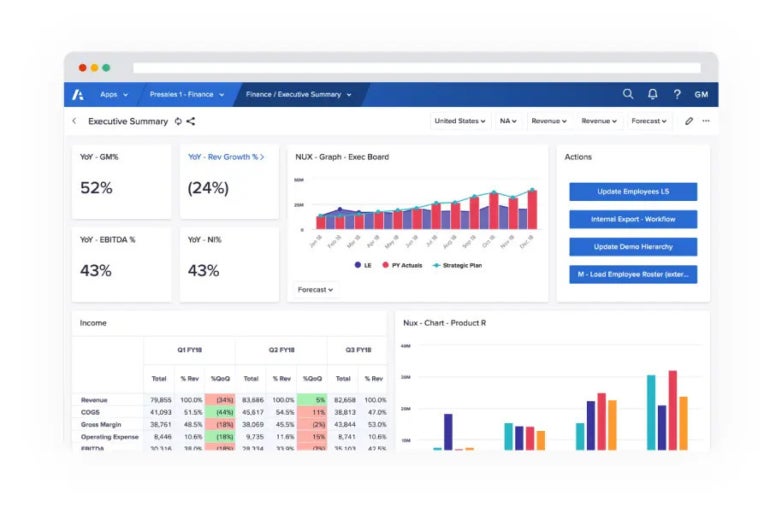

Figure A

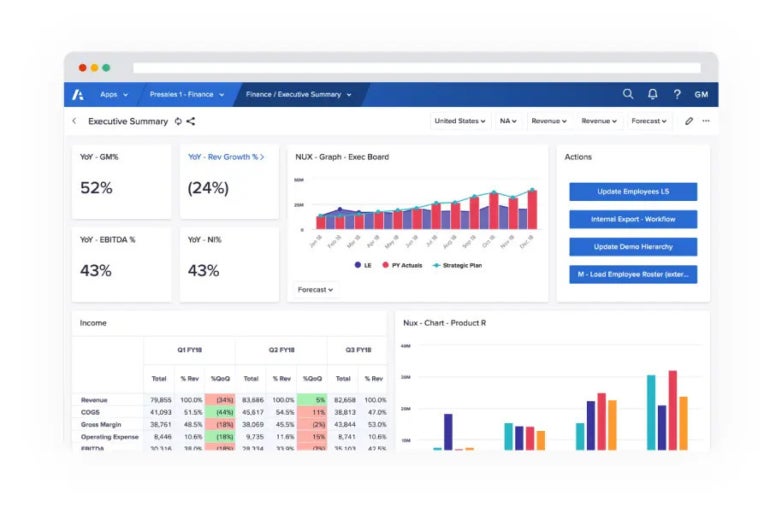

Figure B

Decide on your budget

Budget is often a major factor in choosing a financial forecasting software, so you should start thinking about that at the very beginning of the process. Some software companies only charge for report creators or managers, while others charge for every single user, even passive viewers. Ask the various software platforms for pricing quotes so you can start comparing the costs to your budget.

Sign up for free trials and demo calls

Some financial forecasting software offers free trials, so you can test out the software for yourself. Other software don’t offer free trials, but the sales teams will do a live demo on a video call to answer all your questions. This is a perfect opportunity to test out the most essential features — we listed some in the next section to give you an idea of what to look for.

Investigate the integrations

Integrations are essential to any software platform, and they’re especially important for financial forecasting software if you plan to import the data from another tool. Inquire about pre-built connectors as well as the ability to create your custom integration through an API or other means.

Examine the security measures

Keeping your financial integration is essential for protecting the integrity of your business and maintaining compliance with various national and international laws. Investigate each financial forecasting software on your shortlist to see what security protocols they offer. Keep in mind that some platforms confine certain security features like two-factor authentication to more expensive enterprise-level accounts, so that might affect your budget.

What you should look for in financial forecasting software

Multiple apps and deployment options

The best financial forecasting software offers both a web app and a mobile app, so you can access your reports on the go. Some software platforms go a step further, offering desktop apps and sometimes even an on-premise deployment option for those who want to host the software on their own.

Reporting templates

Generating financial forecasts by hand is time consuming and prone to error, which is why most software comes preloaded with multiple financial reporting templates to make forecasting easy. The software should also enable you to edit the templates or create your own from scratch, then save the customized template for later use.

Data import

In some cases, the data you need for a financial forecast will already be in the software — but in other situations, you’ll have to import it into the tool. The software should offer multiple methods for easy and accurate data import, including pre-built integrations and spreadsheet uploads.

Error notifications

Mistakes and errors can result in very inaccurate financial forecasts, which is why many modern financial software platforms will automatically notify you if data seems to have been entered in error. This helps to reduce human error and results in more accurate financial forecasts.

Machine learning insights

Many platforms are now hiring the power of machine learning and artificial intelligence to augment human interpretation of financial reports. This technology identifies trends and insights so that users can investigate them further to see if they’re worth pursuing. While it’s no replacement for human analysis — at least, not yet — this feature is a nice perk of financial forecasting analysis.

Frequently asked questions

What is the difference between forecasting and budgeting?

Budgeting and forecasting are two essential financial activities that are closely related to each other, but they aren’t exactly the same thing. Forecasting involves predicting future business performance (either short or long term) based on current and past performance. Budgeting is the process of setting financial goals for a certain period of time, typically one fiscal year. Forecasting predictions are often used to both set the budget initially and monitor progress along the way.

How do you create a financial forecast?

First, you must decide on your purpose for creating a financial forecast and gather all necessary financial statements and data. Next, you must decide on both a time period and a financial forecast method for your predictions. Then you must either analyze the data and run the calculations yourself or get the financial forecasting software to do it for you.

How are financial forecasts used in financial planning?

Financial forecasting is extremely useful for modeling the results of various financial plans to see how the plans will affect a company’s financial performance. After laying out the changes to be made in your business plan, you can input the data into your financial forecast model to see what revenue and expenses the financial plan will incur. Many platforms can automate forecasting, budgeting and planning all at once, so you can keep your data in a single software.

Featured Partners: Finance Software

1 Creatio CRM

Creatio CRM for Financial Industry offers an award-winning CRM, a great variety of financial apps, and unlimited freedom of innovation with no-code development tools! Creatio CRM enables financial companies to streamline and automate lead management workflows, run multi-stage multichannel marketing campaigns, build intelligent scoring and qualification models with ML/AI tools, and many more. With Creatio no-code tools, you can do as much as replicate your company’s very DNA in a digital form.

Source of Article