Australia sees its share of natural disasters, like the black summer bushfires of 2019–2020 and the 2022 floods that turned into the most expensive natural disaster in Australia’s history. In times of crisis, or just when making everyday property insurance decisions, insurers rely on data.

Nearmap CEO Andy Watt said Nearmap’s aerial image and data intelligence is helping the insurance industry innovate. With the acquisition of platform Betterview, he said the industry can expect even better support for decisions, streamlining underwriting and premium pricing.

Jump to:

Nearmap matures from aerial image capture to data intelligence

Founded in 2007, Nearmap started out as an aerial image and image processing technology firm. Using its aerial cameras, the startup was able to capture images over large-scale areas efficiently for a range of use cases across the private and public sectors (Figure A).

With the fourth generation of its proprietary camera system in the field, Nearmap now captures higher resolution images with additional oblique viewing angles. It has also improved 3D reconstructions, and its near-infrared surveys enable artificial intelligence insights like vegetation classification.

SEE: AI safety and ESG reporting are two emergent Australian use cases for operationalised AI.

But the biggest shift in the business has been to turn image data into intelligence.

“We realised it was the intelligence and answers customers ultimately want, as part of the problems they are trying to solve,” said Nearmap’s Andy Watt. “We went from being really broad brush to picking specific industries like insurance, where we could see our technology could have a huge benefit.”

Betterview acquisition upgrades platform and data in insurance

Nearmap’s acquisition of Betterview in December 2023 sees it continue that intelligence push. The combination sees Nearmap add a highly configurable platform with additional data types to a fuller property risk intelligence offering for insurers, which includes over 100 AI attributes.

“This adds even more value in terms of understanding the nature of the property that sits on the ground,” Watt explained. “We’re kind of combining forces to give us even more attributes that allow us to service those insurance customers ever more readily.”

How Nearmap’s image data intelligence is helping insurers

Nearmap’s aerial survey images are taken by aircraft. This places it in the “sweet spot” between images captured by cameras at street or drone-level and those provided by satellites. Watt says this height is able to efficiently capture useful images of large urban areas and cities.

“And we can repeat the capture regularly each year,” Watt said. “We capture Sydney six times a year, for example. Drones are fabulous for a small area building site or for specific projects, but you can’t scale drones across large urban areas.”

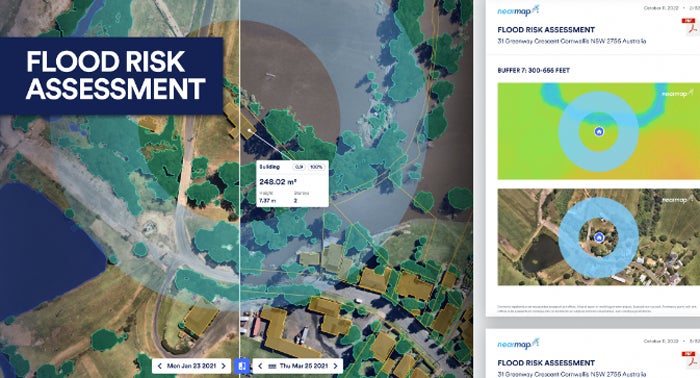

For insurers, these images represent valuable data that can help them make risky decisions. For example, they can show everything from the level of deterioration of a roof over time to how at-risk the property is of being flooded, feeding into underwriting and premiums (Figure B).

Using AI attributes to provide automated risk recommendations

The AI attributes Nearmap can offer insurance and other customers make it more valuable.

“A picture tells a thousand words, right?” said Watt. “The number of individual features — whether a property has a chimney, the pitch of the roof, what the roof is made of, is it shingle, whether it is a flat roof — these aspects all feed into the insurance company’s underwriting model.”

SEE: Community buy-in could be holding Australia back from reaping the benefits of AI.

Watt said the extracted information, which can be compared to historical image data captured over 15 years, feeds into scores and weightings. These help insurers decide if they will write the risk and at what price, which can lead to big dollar savings across sizable insurer portfolios.

“We’re able to provide that answer to give confidence and certainty when providing that underwriting and premium valuation. It cuts out time and increases accuracy, and ultimately the insurance company improves their (return on investment) in terms of their management and premium.”

An eye in the sky during catastrophes like bushfires and floods

Nearmap’s aerial surveys provide critical intelligence to insurers in catastrophe-prone Australia, where properties have been affected by disasters like bushfires, floods and cyclones (Figure C). Watt said it provides a way to better understand and evaluate how these events are playing out.

“From an insurance company perspective, as an event is apparent or looks apparent, we can make sure we have up-to-date imaging prior to the event,” Watt said. “We will also look to capture content after the event as soon as it is safe — within a matter of hours or days.”

Watt said this can be packaged up for insurance companies and government agency clients.

“It enables the insurer to have more real time access to data showing what’s happened on the ground before they can get people in to see the damage themselves,” said Watt. “For people impacted, it can give them a very quick resolution to the claim at a time their lives are flipped on their head.”

InsurTechs and tech professionals innovating in insurance

Watt said InsurTech companies have been growing significantly for a number of years in the insurance industry.

“It’s attracted a great number of innovative companies and tech professionals because the problems we’re solving here are really significant,” said Watt.

This has opened the eyes of the industry to the power of technology and innovation. Watt said the current power of aerial imaging and data intelligence is a far cry from the days when the assessment process involved getting to properties in person to make manual assessments.

SEE: Trends Australian data pros should consider ahead of 2024.

“Insurance is kind of an old school industry, where there’s still certain ways of doing things. It is slightly risk-averse by nature,” said Watt. “But I think there’s been a real change in appetite across the insurance world to embrace technology and innovation.”

Tech consolidation likely to move towards ‘single source of truth’

The technology ecosystem in insurance includes a number of different players in different segments, from policy administration platforms to image data like Nearmap. Watt said the future would likely see a consolidation of the stack into more of a single source of truth.

Watt said that while the changes over the last 10 years “have been so significant,” there is “still a long way to go,” which makes it an exciting industry for tech professionals to be involved in.

“This is a highly innovative space. It has already transformed traditional industry, and it’s only going to continue,” said Watt. “I actually think insurance is the wedge that is almost going to change a whole bunch of other industries that will follow suit as well.”

Source of Article