The global mad dash to construct the next generation of artificial intelligence (AI) data centers is now creating unprecedented pressure on supply chains and energy infrastructure.

According to the newly released 2025–2026 Data Center Construction Cost Index from professional services firm Turner & Townsend, it’s time for companies to take notice.

The report analysis draws on data from 52 global markets and includes an annual survey of more than 280 data-center industry experts. Its results reveal insights into power availability, cost inflation, and additional pressures surrounding the drive towards AI data center innovation.

Supply chain and power challenges threaten the AI revolution

While data center developers race to support increasingly dense AI workloads, operators struggle to ensure timely access to energy grids. As such, power availability has become “the biggest single challenge” for delivering data centers, with 48 percent of respondents citing it as the main obstacle to meeting delivery schedules.

Perhaps the most striking finding of the study revealed that 83 percent of experts believe “supply chains are not well-equipped to deliver the advanced cooling technologies required for AI data centers.”

Turner & Townsend’s research shows that as AI data centers require more power and advanced liquid-cooling systems, both utilities and suppliers must rapidly evolve to keep pace with the technological shift and increased AI demand.

Climbing costs continue per rising demand

Global construction cost inflation for traditional data centers is projected at 5.5 percent in 2025, driven by sustained demand and limited capacity in key markets. The study also identifies a 7–10 percent cost premium for AI-ready facilities in the U.S. compared to traditional data centers of equivalent capacity, indicating the financial impact of advanced power and cooling requirements.

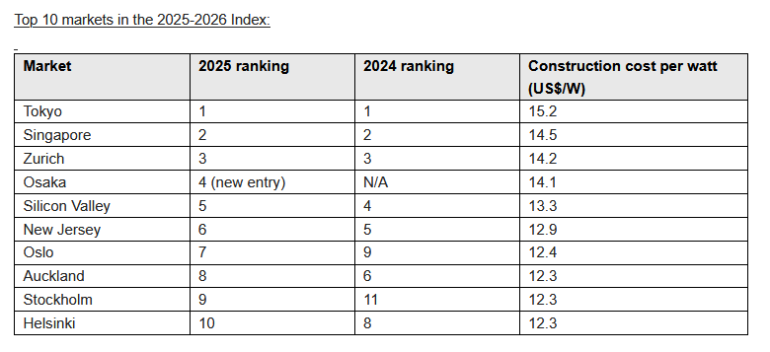

According to the report, Tokyo ($15.2 per watt) and Singapore ($14.5 per watt) top the list of the world’s most expensive data center markets, followed by Zurich ($14.2 per watt). Other major hubs such as Silicon Valley ($13.3 per watt), London ($12.0 per watt), and Frankfurt ($11.6 per watt) are also present in the top tier.

Adapting to meet AI demand

Paul Barry, Data centers Sector Lead for North America at Turner & Townsend, urged that the industry must adapt quickly, stating “AI data centers are more advanced, larger, and by extension, costlier. Developers must embrace off-grid design solutions and strengthen supply chains to meet the rising demand for power and cooling technology.”

The report warns that innovation in design, procurement, and energy efficiency will be crucial to power the advancing AI transformation. Developers and operators must adopt new procurement strategies capable of strengthening supply chain resilience, while embracing alternative energy design solutions to deliver the next generation of data centers.

Cisco and Nvidia are reinventing the data center for the AI era with new hardware, shared blueprints, and a vision for faster, smarter AI infrastructure.

Source of Article