Wave Accounting and ZipBooks are two popular accounting software options that offer a forever free tier of service. This forever free plan has made these platforms popular among small business owners on a budget.

To help you decide if Wave Accounting or ZipBooks is right for your business, we compare them in this guide.

Jump to:

Wave Accounting vs. ZipBooks: Comparison table

| Features | Wave | ZipBooks |

|---|---|---|

| Starting price for paid plans | $0.00 (only free) | $15/mo. |

| Users on free plan | Unlimited | 1 |

| Bank accounts on free plan | Unlimited | 1 |

| Invoices on free plan | Unlimited | Unlimited |

| Double-entry accounting | Yes | Yes |

| Customized invoices | Yes | Yes |

| Mobile receipt capture | $8 a month | Free |

| Native payroll add-on | Yes | No |

| Payment processing | All major credit cards and direct from bank accounts | All major credit cards or integration with PayPal, Square or Stripe |

| Native time tracking | No | Yes |

| Try Wave | Try ZipBooks |

Wave Accounting vs. ZipBooks: Pricing

Wave Accounting pricing

Wave Accounting has a unique pricing structure where the core accounting and invoicing features are free — forever. Other features can be purchased on an a la carte basis. The pricing structure is as follows:

- Accounting: Free forever.

- Invoicing: Free forever.

- Credit card payments: 2.9% (or 3.4% for AMEX) + $0.60 per transaction.

- Bank payments: 1% per transaction.

- Mobile receipts: $8 per month or $72 per year.

- Payroll: $40 per month in tax service states and $20 per month in self-service states, plus $6 per active employee or independent contractor paid each month.

- Advisors: $149 per month for ongoing bookkeeping support, or $379 for a one-time accounting and payroll coaching package.

A 30-day free trial of the payroll software is available.

Learn more in our Wave Accounting review.

ZipBooks pricing

ZipBooks follows a more traditional pricing structure, with an entry-level free plan followed by increasing pricing tiers:

- Starter: Free forever for one user and one connected bank account.

- Smarter: $15 per month.

- Sophisticated: $35 per month.

- Accountant: Contact the sales team for a pricing quote.

A 30-day free trial is available for both the Smarter and Sophisticated plans.

Wave Accounting vs. ZipBooks: Feature comparison

Forever free plan

Both Wave and ZipBooks offer forever free plans, but they each take a slightly different approach to the pricing structure. Wave’s accounting and invoicing features are free forever, with few restrictions. Users, clients, vendors, invoices, expense tracking, accountants and bank accounts are all unlimited with Wave. This makes it a cost-effective solution for many businesses, even if they grow over time.

SEE: Wave Accounting vs. QuickBooks (2023): Accounting Software Comparison

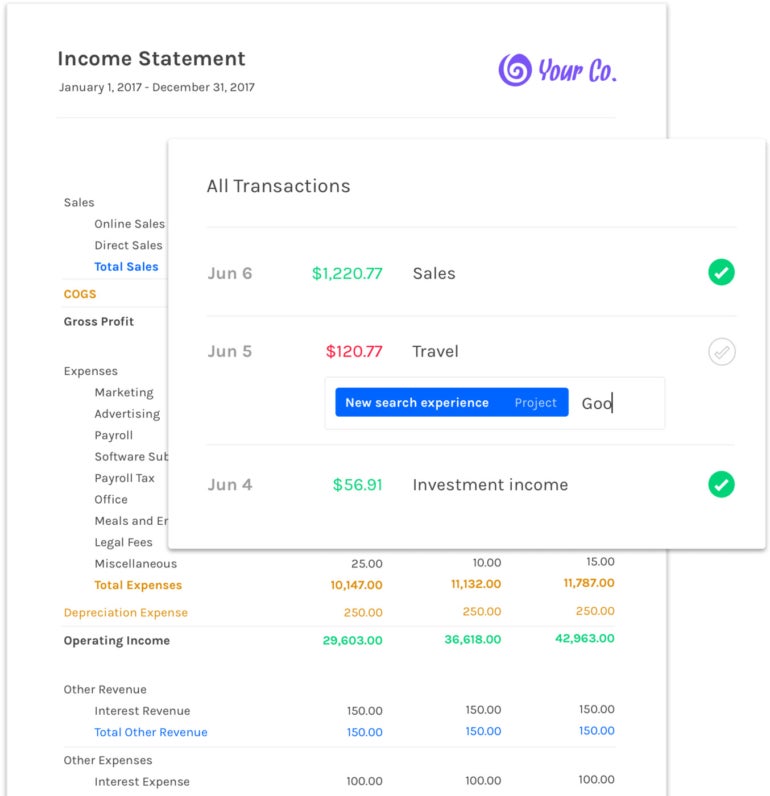

Meanwhile, ZipBooks’s free plan is limited to just one user and one connected bank account — although invoices, vendors and customers are unlimited. If you need more, you’ll need to upgrade to a free plan. These limits mean that ZipBooks (Figure A) is best suited to freelancers and solopreneurs, as well as very small businesses where no one else will need to access the accounting software.

Figure A

Accounting

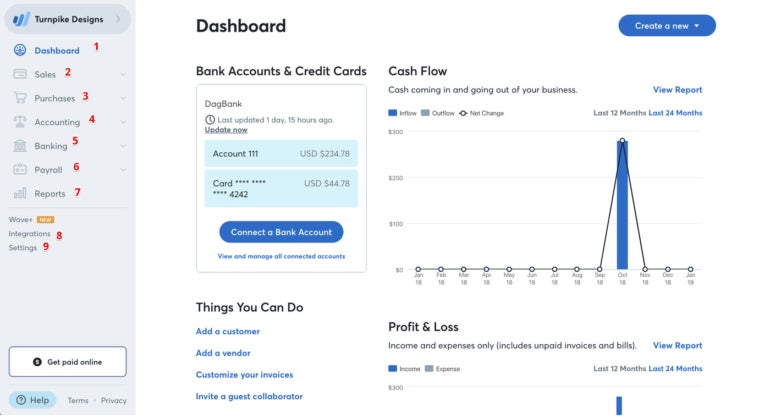

Wave uses double-entry accounting to make things easy on your accountant. The smart dashboard (Figure B) centralizes your income, expenses, payments and invoices all in one place. Wave offers basic reports on essentials like profit and loss statements, balance sheets and cash flow to give you insight into the health of your business. For security purposes, bank data connections are read-only and use 256-bit encryption.

Figure B

ZipBooks also uses the double-entry accounting approach. It automatically pulls in transaction information from your bank or banks and makes it easy to reconcile all your bank accounts. It automatically categorizes your transactions and tracks the money you make and the amounts owed in your accounts receivable report. It also lets you perform project-based accounting through tagging and time tracking.

Invoicing and billing

Wave lets you create professional-looking invoices quickly, then send them directly to your customers in seconds. Set up recurring billing for repeat customers and access all your customer information in one place. The invoicing and billing information flows right over into the accounting tool, minimizing accounting work required.

SEE: Wave vs. Xero (2023): Accounting Software Comparison

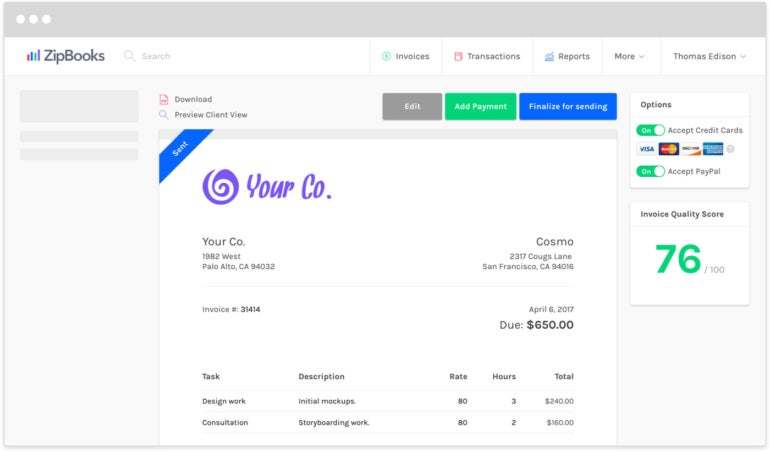

ZipBooks also lets you customize your invoices (Figure C) and provide suggestions for improving them. Plus, you can create estimates and later convert them into invoices with a click of a button. Track whether or not your invoices have been viewed, set up recurring billing and automatically remind customers to pay outstanding bills.

Figure C

Expense management

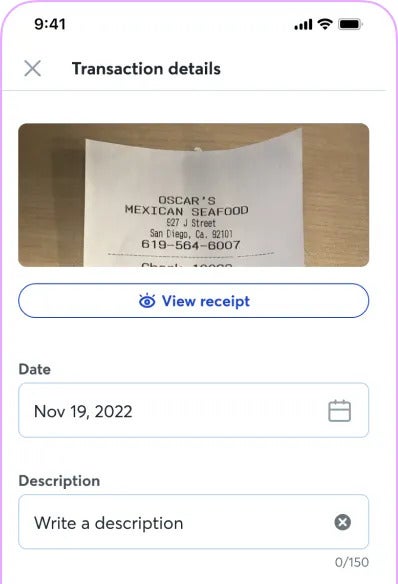

Wave gives you the option to track receipts through its mobile app (Figure D) with a paid add-on. The app uses OCR technology to scan receipts and import data in seconds, and you can add up to 10 receipts in bulk at a time. Wave also backs up your receipts to the cloud in case anything goes wrong with the app.

Figure D

ZipBook’s mobile app also makes it possible to capture receipts on the go, which is a free feature for all accounts. Plus, you can automatically add billable expenses to invoices and split an expense across multiple categories for more accurate accounting. You can also manage your vendors and how much you owe them in the interface.

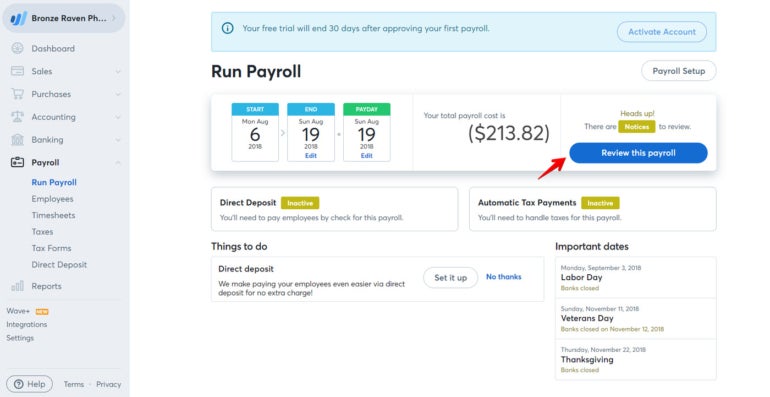

Payroll

Wave can be used for purely accounting and invoicing tasks. However, if you also need a payroll software, you can pay for Wave Payroll as an add-on (Figure E). The payroll and accounting tools easily connect to increase accuracy and reduce time spent on manual bookkeeping. Wave can currently calculate and file payroll taxes in 14 states, with more in the works, and it can generate W-2 and 1099 forms for tax season. It will also directly deposit wages and let employees manage their pay stubs through a self-service portal.

Figure E

On the other hand, ZipBooks does not offer a native payroll tool and instead relies on an integration with Gusto for payroll. Gusto is a highly rated payroll service. To learn more about it, take a look at our full Gusto review.

Payment processing

Wave allows you to accept payments directly instead of forcing you to use a third-party tool, and it charges transparent payment processing fees. Wave accepts all major cards: Mastercard, Visa and American Express. With Wave, you can accept credit card payments online, over the phone or in person. It’s also compatible with Apple Pay and accepts payments from bank accounts. Wave is PCI Level-1 certified for handling credit card and bank account information.

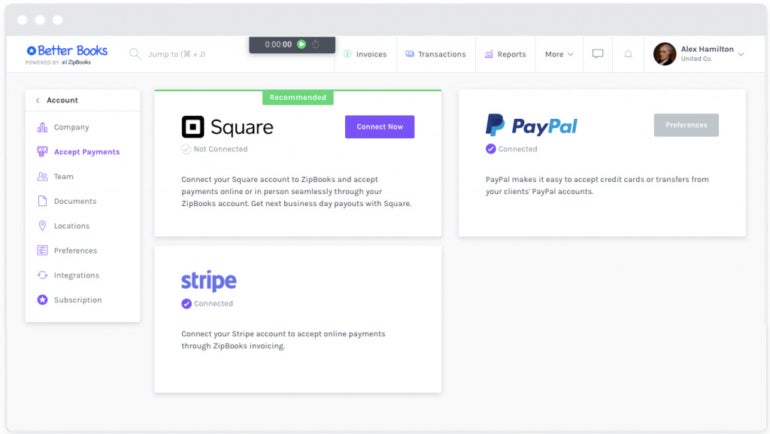

ZipBooks says it also accepts all major credit cards, though it doesn’t specify which ones, and it charges a processing fee of 2.9% per transaction. ZipBooks also integrates with PayPal, Square and Stripe (Figure F), each of which charges slightly different payment processing fees. And you’ll need to update to a paid plan if you want to accept Stripe payments.

Figure F

Integrations

Wave does not offer any native pre-built integrations. Instead, you must use a third-party service like Zapier or Zoho Flow to connect with outside apps.

SEE: The Top Wave Accounting Competitors and Alternatives for 2023

In contrast, ZipBooks offers a few limited integrations with Gusto, Stripe, Square and PayPal. For all other integrations, you must use a third-party service as well.

Wave Accounting pros and cons

Pros of Wave Accounting

- Free forever plan with no limits on users or bank accounts.

- Native payroll add-on option.

- Can manage multiple businesses in one accounting software.

- Very user-friendly software and setup.

Cons of Wave Accounting

- Accounting is not as robust as paid competitors like Quickbooks.

- Support limited to email and live chat only.

- No native time tracking feature.

- Some U.S. states are limited to self-service payroll only.

ZipBooks pros and cons

Pros of ZipBooks

- Unlimited invoices, vendors and customers on the free plan.

- Native time tracking included.

- Paid pricing tiers are very affordable.

- Project accounting and tracking.

Cons of ZipBooks

- Free plan limited to one user and one bank account.

- Could use more reports.

- No Android app available.

- Support limited to email and live chat only.

Methodology

To compare Wave accounting and ZipBooks, we considered features such as double-entry accounting, invoicing, mobile receipt capture, payroll services, payment processing and reporting templates. We also weighed factors such as pricing, ease of use and customer support accessibility. While writing this review, we consulted product documentation and read user reviews.

Should your organization use Wave Accounting or ZipBooks?

Wave offers a simple, no-frills accounting software that will suffice for many small businesses. The free plan offers users, clients, vendors, invoices, expense tracking, accountants and bank accounts — which means you can manage multiple businesses with just one account. However, its accounting features are not complex enough for growing or larger businesses. Payroll and mobile receipt capture are available but only as paid add-ons, and Wave does not integrate with third-party payment platforms.

The limitations of ZipBooks free plan — just one user and one connected bank account — mean it’s best suited to freelancers, solopreneurs and very small businesses. However, it does offer unlimited invoices, vendors and customers on the free plan. Its time tracking and tagging features make it a good choice for project-based accounting as well. It offers free receipt capture for all plans via its iOS mobile app, though no Android app is currently available. ZipBooks also integrates with three major payment services.

Both Wave and ZipBooks are great solutions for entrepreneurs and small-business owners looking for forever free accounting software. However, the complexity of their software can’t match that of paid competitors, including the ever-popular QuickBooks, making these platforms a good choice for businesses with simple accounting needs.

If neither Wave Accounting nor ZipBooks feels right for your needs, check out our recommendations for the best accounting software for small businesses.

Featured accounting solutions

Source of Article