In its first half of the FY24 report, Commonwealth Bank of Australia announced that, through “responsible scaling of AI,” it has already produced more than 50 generative AI use cases. The bank says that it will simplify operational processes and support new customer experiences.

Beneath that dry language, it’s worth paying attention to what CBA is doing with AI because it remains the trendsetter with technology, and its experiments with AI are likely to be transformative, particularly with regard to how banks can deliver personalisation and better understand and respond to the behaviour of their customers.

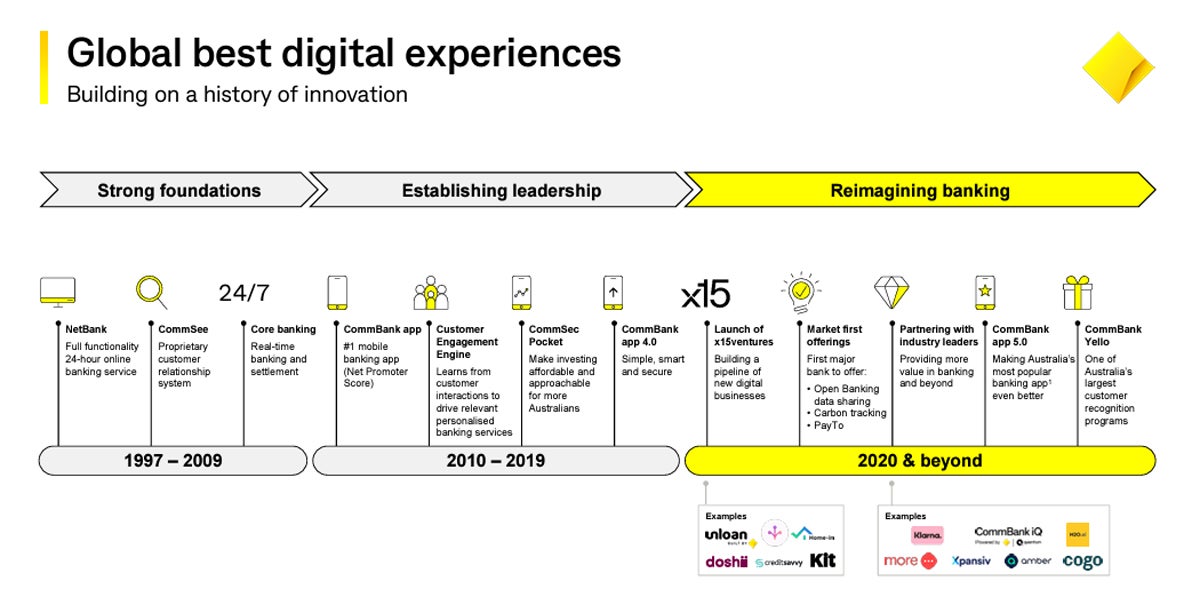

What established CBA as a leader in technology

In April of 2008, Commonwealth Bank of Australia announced that it was embarking on a AUD $580 million (USD $379.32 million) four-year program to modernise its legacy core banking and then start to be able to introduce some new features. This project was one of the earlier examples of a major digital transformation project among financial services organisations.

PREMIUM: Download this free guide on the top Fintech predictions for 2024.

This was driven by a desire to deliver IT services to customers, as then CIO Michael Harte said at the time.

“Commonwealth Bank has always strived to change the way that it delivers IT services. This effort has redoubled to gain advantage in the past seven years,” Harte said. “We have modernised our infrastructure by rolling out a new data IP network, building a new IP telephone network, modernising our mainframes, consolidating our data centres from 23 down to two and introducing security and privacy solutions. And of course, we undertook to modernise our core banking platform.”

An early example of the innovation that came from that was CBA’s ability to be the first bank to launch an EFTPOS solution that allowed it to own a direct relationship with merchant customers and their payments.

Looking forward, the company has an ongoing commitment to investing in digital, with “market first offerings” being an explicit goal (Figure A).

What is CBA doing with AI?

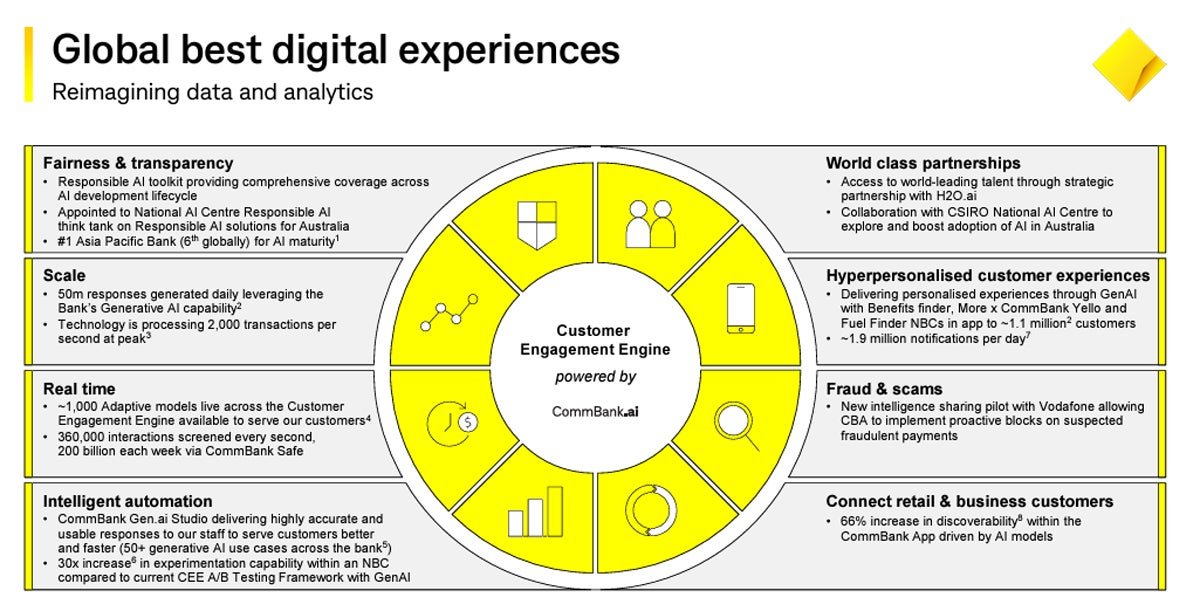

Commonwealth Bank of Australia’s market report highlighted three goals for the company with AI:

- Utilise AI to deliver personalised customer experiences. CBA noted that there has been a 66% increase in customer engagement through the CommBank app.

- Responsible scaling, which has to date resulted in more than 50 generative AI use cases to simplify operational processes and support the bank’s frontline in customer service.

- Upskilled over 500 staff on AI tools, which in turn allows the bank to democratise the responsible use of AI across the organisation.

Chasing these goals led to CBA launching the CommBank Gen.ai studio in mid 2023. One of the first applications of that, which it announced at the 2023 South by Southwest, was to examine how well generative AI chatbots can not only provide the information a customer is looking for but also emulate their behaviours.

As CBA Chief Decision Scientist Dan Jermyn said at the time, “We’re using this advanced technology to explore creating customer personas or ‘synthetic agents’, where GenAI chatbots act as an early experimentation tool.”

AI delivering a new frontier of personalization

This has the potential to deliver extreme personalization. As CBA CEO Matt Comyn said in a call to discuss the results with analysts, early examples of that have been positive. Commonwealth Bank of Australia had, for example, used its AI-supported customer engagement engine to make personalised pricing offers to home loan customers, coming off a fixed-rate loan, in real time.

SEE: Australian organisations are working to balance personalisation and privacy.

Overall, CBA expects AI to enhance its CEE across several different categories, including scale, fairness and transparency, the ability to combat fraud and scams, and better connection with retail and business customers (Figure B).

How CBA Is Bringing AI And Customer Engagement Together

It’s easy to forget that this current wave of innovation around AI is relatively new, and generative AI has only really become a mainstream concept over the last 18 months. Commonwealth Bank of Australia was one of the first to embrace that, and while there’s a lot of innovation that will come from AI that we’ve not yet conceptualised, what CBA does with its tools will be monitored by financial services across the world.

Most significantly, CBA’s efforts in innovation generally are precision-focused on delivering outcomes for customers, and AI is following trends there. The bank is also focused on building knowledge and capabilities across the market.

As noted in KPMG analysis of Commonwealth Bank of Australia’s successes:

“First, they spend significant time and effort listening to their customers. Some of that ‘listening’ is done by the machine learning algorithms running in the CEE. But CBA is also keen on human-to-human listening. The bank’s efforts to create dynamic partnerships has also helped them move ahead. Not just by adding innovative models and services, but also by helping the business develop, innovate and co-create.”

In short, it’s important to keep a close eye on what CBA is doing with AI because it’s likely that its experiments now will become standardised approaches to generative AI in financial services in the future.

Source of Article