Zoho Expense: Fast factsStarting price for paid plan: $3/active user Key features:

|

Zoho Expense is a cloud-based, stand-alone business expense tracking app offered by Zoho. Zoho Expense is also available as part of the Zoho One bundle plan.

To help you decide if Zoho Expense is right for your business’s needs, we will do a deep dive into its pricing plans, features, pros and cons in this thorough Zoho Expense review.

Jump to:

Featured partners

Zoho Expense’s pricing

Free

This plan is free for up to three users. Features include:

- 5 GB receipt storage.

- 20 receipt autoscans.

- Multi-currency expenses.

- Mileage expenses.

Standard

The Standard plan costs $3 per active user per month billed annually, or $5 per active user per month billed monthly. It requires a minimum of three users and supports unlimited users. A 14-day free trial is available for this plan. Features include:

- 20 receipt autoscans per user.

- Corporate card reconciliation.

- Cash advances.

- Multi-level approval.

Premium

The Standard plan costs $5 per active user per month billed annually, or $8 per active user per month billed monthly. It requires a minimum of three users and supports unlimited users. A 14-day free trial is available for this plan. Features include:

- Travel requests.

- Purchase request.

- Advanced approval.

- Per Diem automation.

Enterprise

The Enterprise plan costs $8 per active user per month billed annually or $12 per active user per month billed monthly. It requires a minimum of 200 users and supports unlimited users. Features include:

- TMC/OTA integration.

- ERP integration.

- Single Sign On (SAML).

- Dedicated account manager.

If you have more than 500 users, you must contact Zoho Expense for a custom quote. You can also opt for the Zoho One plan, which bundles all of Zoho’s software products — more than 40 tools in all, including Zoho Expense — into a single affordable price plan that costs $37 per month per employee, billed annually.

Zoho Expense’s key features

Receipt management

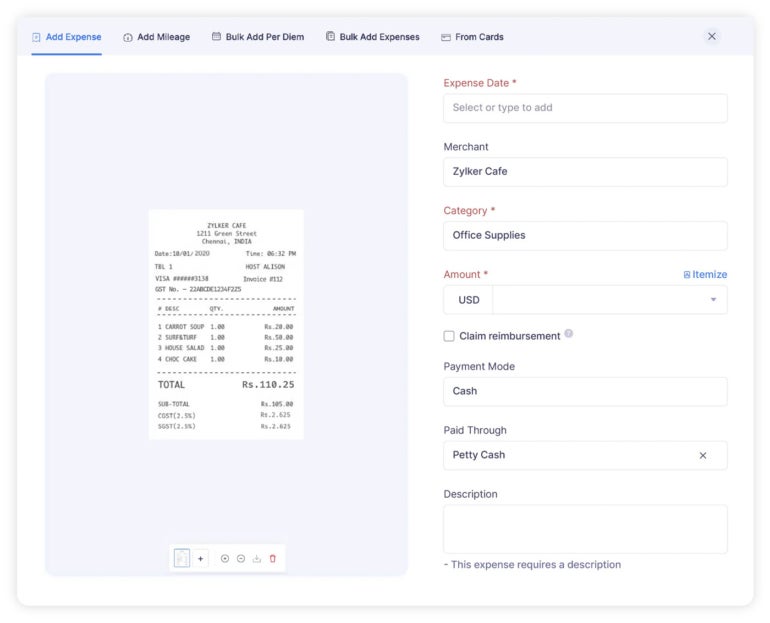

Figure A

Employees can add receipts to Zoho Expense in multiple ways (Figure A): take a photo using the mobile app, drag-and-drop an existing image from your desktop, forward an email confirmation for a reservation or import receipts from other cloud applications. The app’s advanced autoscan feature reads receipts in 14 languages and creates expense records for them. Bulk uploading of receipts is available on all plans, including the free version.

Expense management

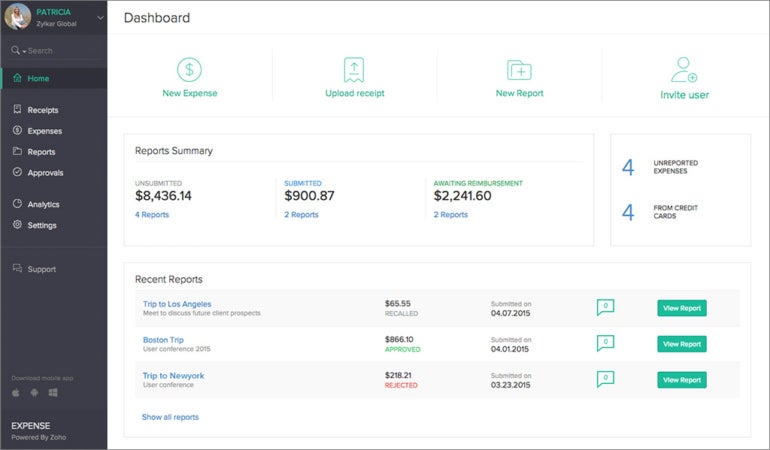

Figure B

Once receipts are in the tools, the dashboard gives you a high-level view of their status (Figure B). You can itemize expenses so they are tax exempted appropriately and split shared expenses by amount, day or custom category. Admins can control what employees see, eliminating unnecessary fields to avoid confusion. They can also set a per diem rate for employees based on location.

Mileage tracking

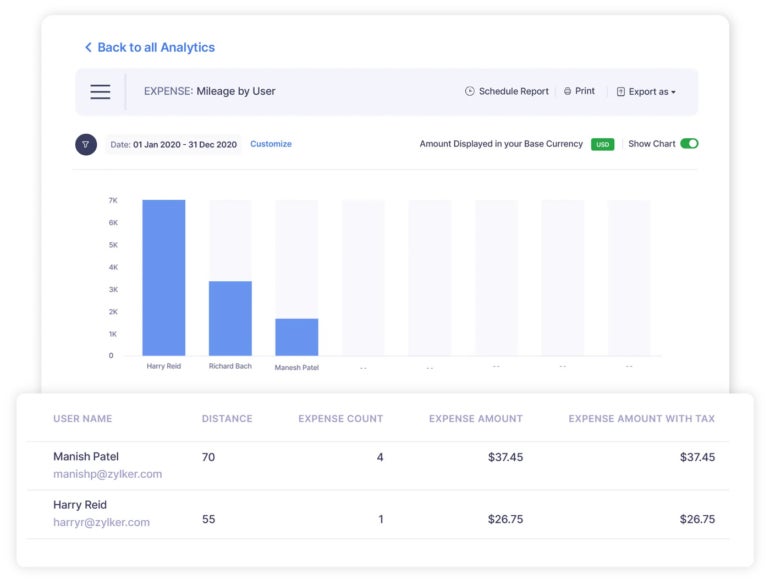

Figure C

Miles can be tracked in four ways on Zoho Expense (Figure C): via GPS, distance covered, point-to-point map locations and odometer readings. Admins can set custom mileage rates for different vehicles, policies, departments or cost centers. Run mileage reports for each user to see how much they’ve tracked for a custom period of time.

Card management

You can connect corporate, prepaid or personal credit cards to Zoho Expense, so purchases will automatically be logged in the system, making it easy to reconcile business expenses. With Direct Feed Integration (DFI), corporate card feeds will be fetched directly from Visa, Mastercard and Amex (American Express), eliminating the need for a middleman and improving security.

Expense control and approvals

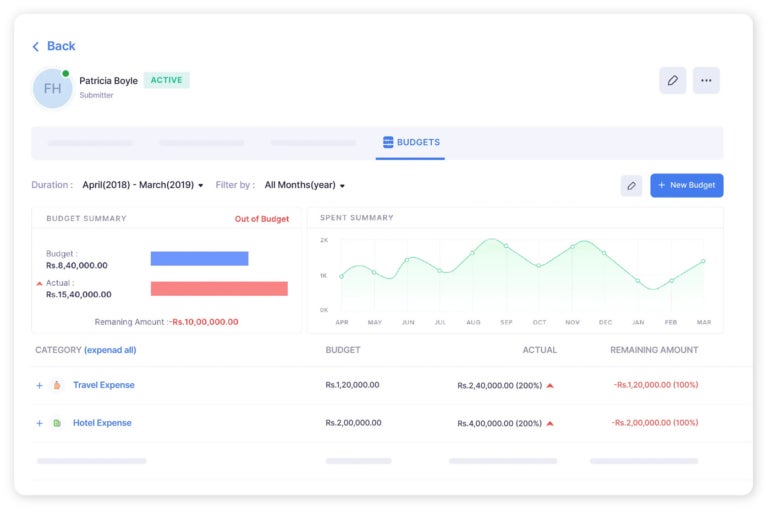

Figure D

Admins can set up expense rules based on fixed amounts, mileage limits and more; these limits can be daily, weekly, monthly or a custom duration. They can also institute expense policies for different brands, departments or cost centers, which will then trigger a notification if a policy is violated. Overall budget limits (Figure D) can also be created for certain expense categories or types, and the system will warn or block employees when their purchase request is about to exceed the budget. Simple, customized approval workflows eliminate repetitive work and keep expenses in check.

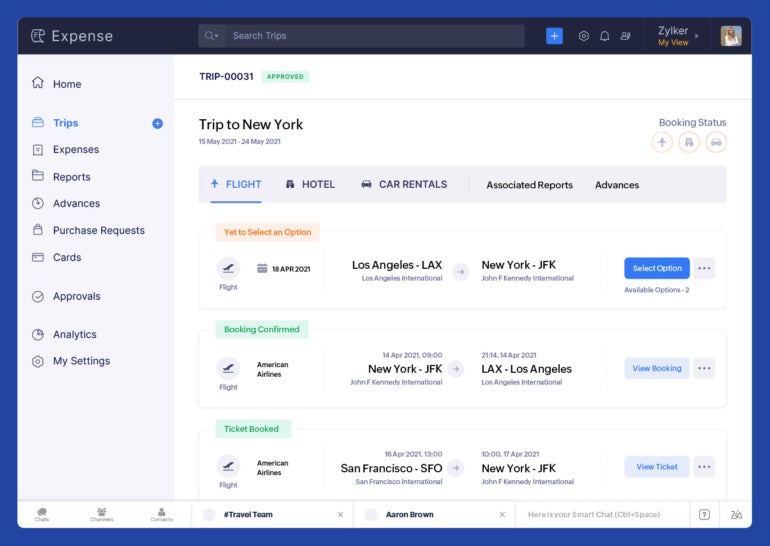

Travel expense management

Figure E

Zoho Expense does offer travel expense management features (Figure E), though these are limited to the Premium and Enterprise plans. The self-booking tool helps employees book their own travel while following company spending policies. The system will freeze a fare while awaiting approval to avoid price surges and notify employees of price alerts so they can re-book at a lower fare. The system also automates visa requests and travel policy compliance.

Expense reports

Figure F

Employees can easily create and submit expense reports for approval with Zoho Expense (Figure F), which will automatically generate unique numbers for you. You can group related expenses like air travel, lodging and food to simplify the report. Employees can also apply cash advances to the report to offset reimbursement amounts and ensure correct calculations.

Zoho Expense pros

- Affordable, transparent pricing plans that will work for many small businesses.

- Forever free plan available.

- Integrates with popular accounting software, including QuickBooks.

- Integrates seamlessly with other Zoho Products.

- Visually appealing and colorful interface.

- Many customizable automation options.

Zoho Expense cons

- Steeper learning curve, especially for people who haven’t used a Zoho product before.

- Free plan’s storage is limited.

- Onboarding and setup processes can be lengthy.

- Must upgrade to the Premium plan for travel expense management.

- Accountants are less likely to be familiar with Zoho vs. QuickBooks.

- Customer support could be improved.

Zoho Expense integrations

Zoho Expense integrates with other Zoho products as well as many popular third-party services, like these:

- Practice accounting and bookkeeping with Zoho Books, QuickBooks, Sage Accounting and Xero Accounting.

- Create and send customized invoices with Zoho Invoice.

- Manage travel expenses with Get There and Routespring.

- Send reimbursement payments with CSG Forte, ICICI Bank and HSBC.

- Submit rideshares for expense reimbursement with Uber, Lyft and Bolt.

- Reclaim VATs after international travel through Taxback International and WAY2VAT.

- Manage documents with Dropbox, Google Drive and Microsoft OneDrive.

- Message coworkers with Slack.

Who is Zoho Expense best for?

Zoho Expense is a no-brainer for any company that already uses Zoho products, especially other finance tools like Zoho Books and Zoho Invoices. Since Zoho uses the same login for all its products, it’s easy to add another to your software stack, and they all integrate seamlessly with each other.

Zoho Expense is also a great choice for small businesses looking for an affordable standalone expense management tool. Many alternatives, such as QuickBooks, bundle the expense management function together with accounting, inventory management and other features. This increases the price of competitor’s plans and may saddle SMBs with extra functionality they don’t need or want.

That being said, if you do need more finance-related features beyond just expense management, you’ll need to look into other Zoho tools for that. Fortunately, most other Zoho products, including Zoho Books accounting, offer a free tier of service as well as affordable paid plans. Depending on what level of functionality you need, it might actually be cheaper to combine several of Zoho’s products instead of springing for a more expensive all-in-one alternative like QuickBooks.

If Zoho Expense isn’t ideal for you, check out these alternatives

For all its advantages, Zoho Expense isn’t the right choice for every business. Some companies need more functionality than just a standalone expense management app. While Zoho does offer Zoho Books and Zoho Invoice, these tools aren’t nearly as popular among accountants as QuickBooks, which can also complicate things come tax season. Here are some Zoho expense alternatives to consider.

FreshBooks

FreshBooks is a more affordable alternative to QuickBooks that includes unlimited expense tracking on its base plan, which starts at $17 a month. FreshBooks also includes other accounting and invoicing features for an all-in-one platform. FreshBooks is a great choice for businesses that are looking for an accounting software that includes expense tracking but don’t want to spend as much money as QuickBooks requires.

QuickBooks

QuickBook is the industry standard in accounting software, and it offers receipt capture and expense management for all pricing tiers, which start at $30 a month. Its popularity means that every accountant will be familiar with it, while the same can’t be said for Zoho Expense. QuickBooks also incorporates everything into one platform, while Zoho breaks out functions into separate products like Zoho Expense, Zoho Books and Zoho Invoice.

Expensify

Expensify is a popular stand-alone expense management tool that is very comparable to Zoho Expense, including its free plan. In addition to standard expense management features like receipt capture, the company offers its own Expensify card, which makes capturing expenses a breeze. You can still use the app with your own credit cards.

Review methodology

To review Zoho Expense, we signed up for a free trial of the Premium plan. We also watched demo videos, consulted user reviews and looked at product documentation. We considered features such as receipt management, mileage, tracking, expense controls and travel expense management. We also weighed other factors such as the user interface design, learning curve and customer support.

Source of Article