Growing up with the harsh economic realities in a Sub-Saharan African country, once or twice, you might have entertained the thought of searching for greener pastures elsewhere. If you didn’t, then as the numbers show, several people did and made good on their plans.

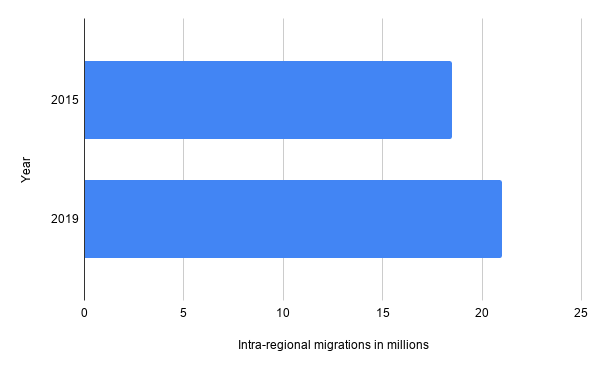

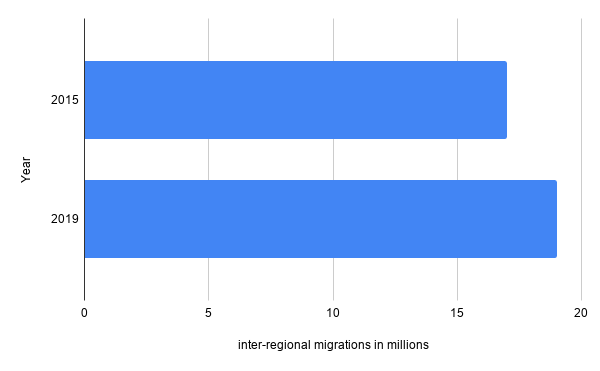

Migrations in Africa involve movements from both within and from the region, and according to the International Organization for Migration (IOM), intra-regional migrants increased from 18.5 million in 2015, to 21 million in 2019, while inter-regional migrants increased from 17 million in 2015 to 19 million in 2019.

These movements have featured a diverse profile of migrants, from skilled workers and entrepreneurs to students and researchers. As global migrations from Sub-Saharan Africa increased over the years, so did remittances from the diaspora.

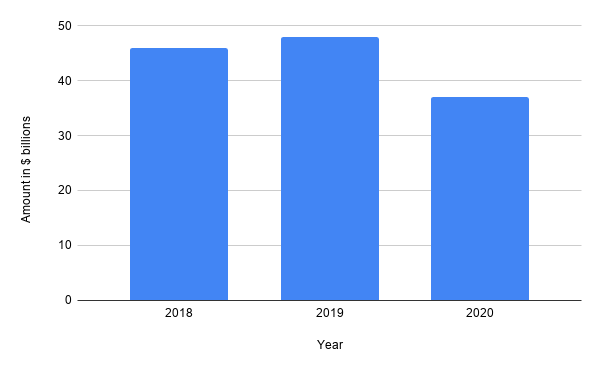

According to a World Bank report on migration, these numbers have brought about a commensurate increase in remittances globally. Supported by strong economic conditions in high-income countries, remittances to Sub-Saharan Africa increased by 4% to $48 billion in 2019.

PricewaterhouseCoopers (PwC), a multinational consulting firm, reports that these amounts usually come in trickles, meaning that the few hundred dollars or pounds being sent by the millions of people abroad are what amount to billions at the end of the year.

Suggested Read: Diaspora remittances can boost investment in small and early-stage businesses – PwC

However, due to the effects of COVID-19 on the economy of the United States, China, and high-income countries in the Middle East and Europe, the World Bank projects that remittances to Sub-Saharan Africa will fall by 23.1% from $48 billion in 2019 to $37 billion in 2020.

This is especially telling, seeing as the World Bank also states that but for remittances, the share of the poor in Africa’s population would have been 5 percentage points higher in Ghana and 11 percentage points higher in Uganda.

The likes of Ethiopia, Ghana, Kenya, Senegal, South Africa, and others have also reportedly benefitted from remittances through jobs, improved education, and reduced child labour.

In 2019, remittances to Nigeria — $25.5 billion — dwarfed income from foreign direct investments and oil revenues for the year.

While the predicted plunge in remittances was induced by COVID-19, other bottlenecks have been plaguing the effective flow of money to the region.

Weighing the costs

Despite the large amounts that have been recorded in previous years, the cost of remittances to Sub-Saharan Africa remains the highest in the world.

In the first quarter of 2020, sending $200 remittances cost ~$18, about 8.97% on the average. This was just a slight decrease compared to the average cost of 9.25% in 2019. Remittance charges between countries in the region are even higher and could go as high as 20%.

To put it in perspective, Africans in the diaspora who sent $48 billion in 2019 spent an average of $4.3 billion in charges sending the money.

These high rates are a side effect of stiff regulations against money laundering in the region. While steep regulatory fees are meant to deter fraudsters, they end up shooting up costs for those legitimately sending/receiving money.

According to the International Fund for Agricultural Development (IFAD), lots of remittances are cash-based, and a monopoly is usually created by a partnership between one money transfer body and an easily accessible national postal agency.

Reports from PwC suggest that lots of remittances are unaccounted for as a result of an increasing reliance on informal methods, usually employed to avoid the hectic and expensive process of conventional ones.

A pandemic induced behavioural change

In the absence of policies that could reduce costs, especially for low-value remittances, a number of digital platforms and interesting fintech partnerships have recently emerged offering relatively cheaper transfer fees.

In 2019, the Nigerian fintech company, Paga, and Vodacom Tanzania partnered with remittance platform, WorldRemit. This year, Airtel partnered with financial giants, Western Union while Flutterwave partnered with WorldPay and Alipay.

Suggested Read: Focus on Africa’s remittance market appears to be increasing with Ecobank and Alipay partnership

Most of these platforms let users send money directly to recipients’ bank accounts and mobile money wallets or sometimes as airtime recharge. This is more convenient than recipients waiting weeks for the sent cash to get to them via post.

Also, though amounts vary depending on the sending/receiving location, compared to the regional average of $18 to send $200, for the same amount, platforms like World Remit charge about $4.99 from the US to Nigeria, and $2.99 to Kenya.

Another platform, Sendwave, allows users from the US, UK, Canada, Italy, Ireland, and Spain to send money with no charges, and collects its commission from the difference in exchange rates.

Though yet to get mainstream attention, the likes of AZA (formerly BitPesa) and other cryptocurrency-based platforms are changing the way cross-border payments are made across Africa.

Suggested Read: Digital foreign exchange platform, BitPesa is easing cross border payments across Africa

The COVID-19 outbreak has caused a global shift in consumer behaviour. According to an American consulting firm, McKinsey, consumers worldwide, have generally shifted towards digital channels, products, and services.

In Africa, platforms like Nigeria’s Paga and South Africa’s Yoco have reportedly been witnessing increased adoption since the onset of the pandemic.

Despite the projected decline in remittances for 2020, there is likely going to be much activity in this space in the coming years, and the use of digital platforms could drive costs down significantly.

The implementation of policies that will drive financial inclusion in sub-Saharan Africa will increase the number of persons able to use these digital platforms. This could then lead to higher competition in Africa’s remittance market that will certainly favour the consumer.

Nigerian startups raised $55.4m in Q1 2020; over 99% of which came from foreign sources. Find out more when you download the full report.

Subscribe to the Techpoint Africa Newsletter for weekly updates

Comments

Source of Article