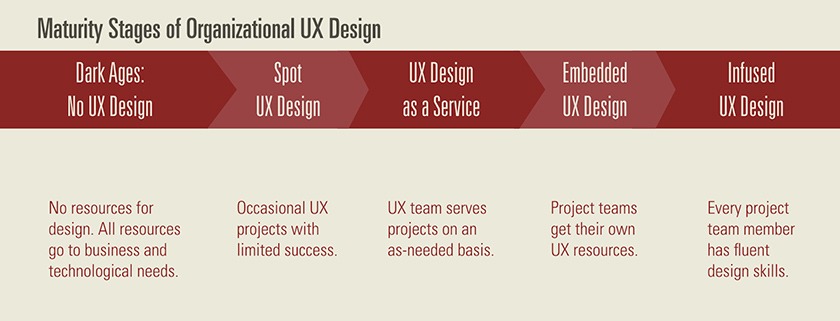

UX maturity levels fluctuate greatly across industries. The longevity of online products reflects this very fact since having the right mindset has the potential of gravitating towards UX as a competitive advantage.

In essence, what we see today in financial services — particularly in B2C vertical — give UX the long-awaited credit it rightfully deserves. From fledgling challenger banks to incumbents with new business services and models, it’s obvious: UX is no more of a nice-to-have touch to polish the packaging. On the contrary, it’s a fundamental tenet upon which you build your business.

Intuitive usability combined with ease of use appeal to all users, making them emotionally connected to certain services. Once a user realizes that a non-existing feature or transaction is available, she becomes overly attached to it, to the first service that is triumphant to offer something transcending the cognitive limits.

The big break of challenger companies in financial services in the last five years is deeply connected with bestowing users with options and transparency via frictionless experiences, which in the end, laid the very foundation of hypergrowth observed.

Users have realized that incumbents are reckless of the new technologies on purpose, more broadly do not give attention to their needs or create services with a user-centric approach.

On the other end of the spectrum, instead of investing in traditional models to get a share from a saturated market, start-ups proliferated with building a new market solely focusing on user needs and pain points. As a result, we all have micro-insurance services, instant bank transfers or smart alerts to keep ourselves financially awake thanks to these disruptors that chose to retain users with prioritizing their expectations.

At SHERPA, we’ve spent a fair amount of time transforming online services once regarded as slower than their offline counterparts. Especially in the digital insurance landscape, we believe we spearheaded the market with the help of our clients who never backed away from focusing on users.

In our past projects in the insurance industry, we aspired to replace old mechanisms with systems that mimic the offline world with intuitive flows, present only what is necessary and —most importantly— walk users through a whole process.

We mainly focused on clarity and usability to revolutionize out-of-date services by following a well-articulated UX strategy each time. And customers’ long habituation to face-to-face offline services and a myriad of legal procedures that should be embedded into online processes were the principal challenges for which we sought answers.

We composed a UX Strategy Blueprint built on the insights we collected which became our reference while making design decisions.

Here is our formula that conceptualizes our perspective towards a financial product or service. The formula for building understandable, self-service funnels to minimize the cost of human involvement.

1. Create intuitive, to-the-point and frictionless flows

Designing sleek, optimal forms & funnels starts well before drawing a single line digitally. User needs along with technical limitations lead the way to find solutions that keep users engaged. Aim to go beyond design and discover what the business goals and user pain points are in the first place.

2. Minimize the cognitive load that users might have to deal with during their journey

Strive to provide content and features that the users will need during their journey in a clear and simple way. Minimize the use of legalese and business-specific jargon by employing progressive disclosure techniques that comply with regulations, instead of removing them all.

When it comes to insurance; develop a robust and business-oriented UX strategy based on principles that will provide solutions to users’ pain points, by providing details in an almost frictionless manner while offering basic understandable information and boosting users’ financial literacy.

3. Augment risk management perception and financial maturity by actively guiding users

Walkthrough the practical benefits of the risk management perception that will be developed by using your tools and services tailored for your user’s expectations.

Do not hesitate to create informative and guiding content that will prove beneficial in the long term. Remember that you need to be perceived as a trusted partner who takes a shot at educating its users rather than merely pushing its products.

4. Reveal users’ unidentified needs through examples and similarities

Do not only provide flows that require clients to choose products they are barely familiar with to make a purchase decision for the service they need. Focus on introducing products that meet users’ needs first through examples, FAQs, and comparisons.

Delve into promoting the differences and connections between your products in a way that will benefit users and bring them forward at the right step. Prioritize the provision of maximum benefits to improve usability through the effort and information gathered by users’ feedback throughout their experience.

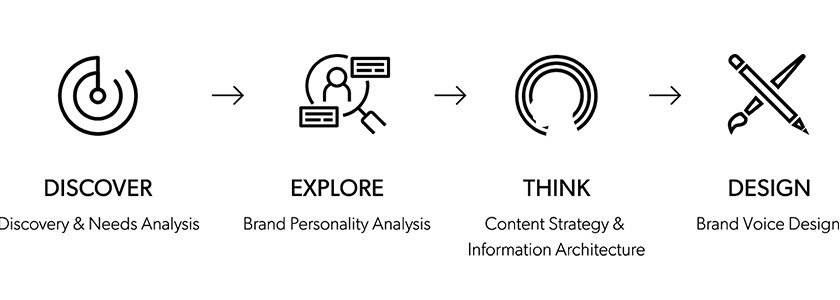

With each product or service, we go back to square one and initiate the first phase of our design methodology: Discover. Needs and wants constantly undergo changes since each product has a unique selling point and a different set of skills digitally.

Taking all of them into account while being attentive to user feedback helps us formulate the optimal experience. On top of that, keeping the four-steps in mind facilitates the Discovery phase.

We started by analyzing internal & external communication across all touchpoints online and offline to discover the existing brand voice of AHE. The discovery phase then proceeded with a competitor analysis in terms of brand voice & tone.

We did manage to write solid stories with the help of our research-oriented approach and relentless pursuit of identifying user expectations for each product.

While working with AHE, we saw that the way of communication with users itself needed to be updated to cope with the changing user needs, whereas with Quick Sigorta project, our focus was to expedite the quotation process since the promise was to find the best quote in seconds.

Stakeholders, users, technical capabilities, and brand vision all provide invaluable inputs to develop a strategy but the mindset shift from being business-centric to user-centric is the key to stay competitive and take a leap further.

About SHERPA

SHERPA has been offering high ROI services for leading multinational and national institutions in a large number of industries from finance to tourism, white appliances to automotive and electronics to retail.

With an extensive portfolio of successful projects to its name, SHERPA has been awarded UX Design Awards Honor Award, IF Design and Red Dot award, all of which are considered to be the most prestigious awards in the world.

Source of Article