Your company’s payroll processing software impacts most aspects of your business, from how happy your employees are at work to how much time you have to spend on time-consuming payroll problems.

Two of the most popular cloud-based payroll software for small businesses — QuickBooks Payroll and Patriot Payroll — were tailor-made specifically to address these issues: Both payroll providers are exceptionally user-friendly with 24/7 customer service, accessible employee portals and time-saving payroll features.

For the most part, QuickBooks Online Payroll is the better choice for users who can afford to spend more on payroll and who want to offer employee benefits. Patriot Payroll, on the other hand, is a solid pick for the smallest of small businesses, especially businesses with a tight payroll budget or with just one or two employees.

Jump to:

QuickBooks Online Payroll vs. Patriot Payroll: Comparison table

| Features | QuickBooks Online Payroll | Patriot Payroll |

|---|---|---|

| Our star rating | 3.6 stars out of 5 | 3.8 stars out of 5 |

| Starting base price | $45/mo. | $17/mo. |

| Starting per-payee price | $5/payee | $4/payee |

| International payroll | No | No |

| Time tracking | With higher-tier plans | Additional fee |

| Workers’ compensation integration | Yes | Yes |

| Optional employee benefits | Yes | No |

| Benefits administration | Yes | No |

| Accounting software integration | QuickBooks Online | Patriot Accounting, QuickBooks Online |

| Learn more |

Plan and pricing information up to date as of 7/12/2023.

Featured Partners

QuickBooks Online Payroll vs. Patriot Payroll: Pricing

QuickBooks Online Payroll pricing

QuickBooks Payroll costs more than Patriot Payroll, but it also comes with more employee-centric features. It also has more plans, each of which includes more HR features as they increase in cost:

- QuickBooks Payroll Core: $45 per month + $5 per employee.

- QuickBooks Payroll Premium: $75 + $8 per employee.

- QuickBooks Payroll Elite: $125 per month + $12 per employee.

All three plans have more or less the same payroll features, including automatic payroll processing, full-service tax administration, 1099 preparation and e-filing, employee benefit administration and more.

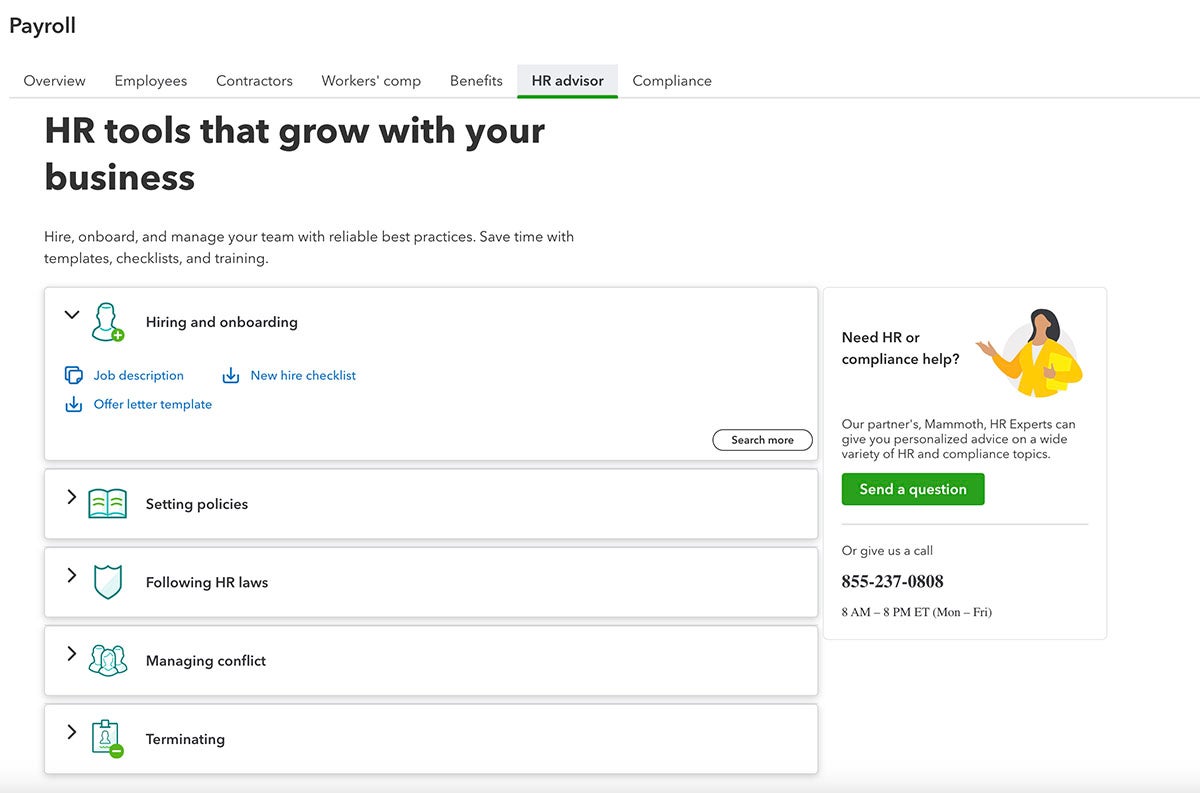

With the two pricer plans, users get same-day direct deposit (rather than next day), They also gain access to an HR resource center administered by QuickBooks’ partner Mineral, Inc. Elite users can also contact an on-demand HR advisor for personalized human resource help.

QuickBooks Payroll does have a few extra fees that interested businesses should be aware of:

- Direct deposit for contractors costs an additional $5 per contractor paid per month.

- QuickBooks Payroll Core users pay an additional $5 per month to integrate workers’ compensation insurance.

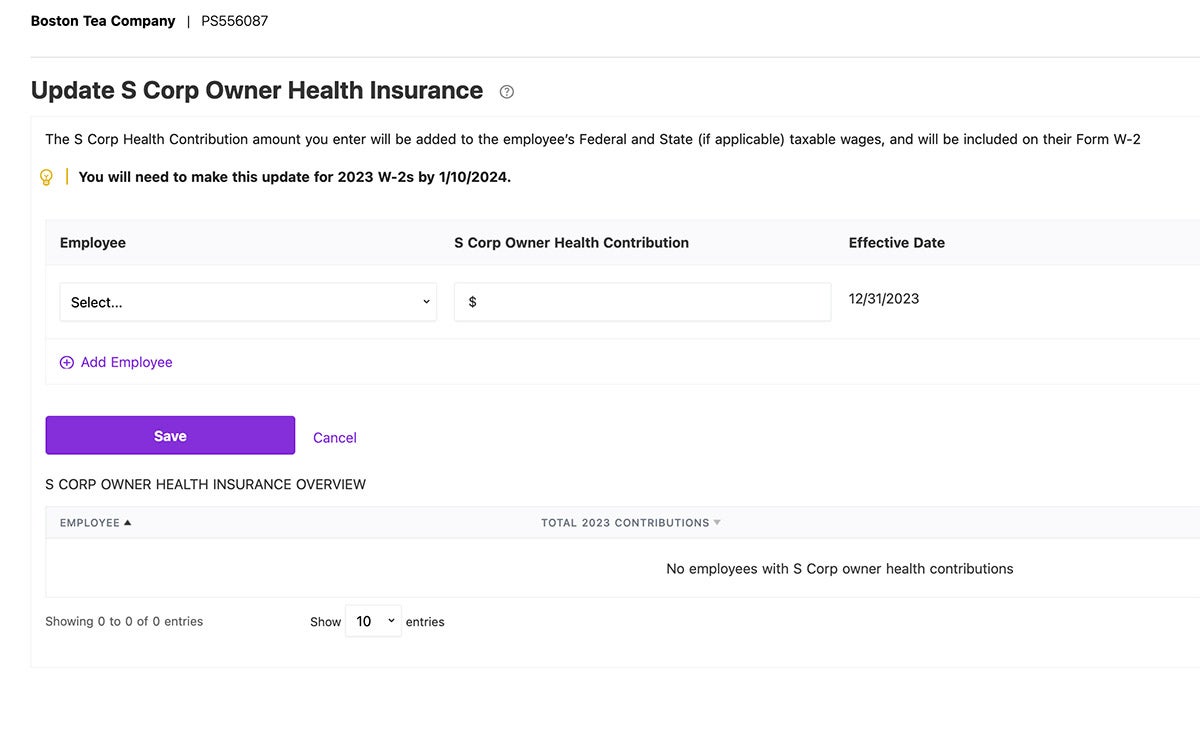

- Integrating health insurance benefits, 401(k) plan administration and workers’ compensation insurance costs an additional, unspecified fee for all plans.

Patriot Payroll pricing

Patriot Payroll’s cost is one of the lowest in the business — though add-on fees can push its pricing up quickly. Patriot’s two plans are identical in every way apart from their tax service: While both plans include tax calculation, only the full-service plan offers automatic tax deduction and remittance:

- Basic Payroll (a.k.a. self-service payroll): $17 per month + $4 per employee.

- Full-Service Payroll: $37 per month + $4 per employee.

Both plans include features like unlimited monthly payroll runs, two-day direct deposit (for some customers), employee self-service and unlimited users with admin permissions. Both plans also share the same add-on fees for certain crucial services:

- Patriot Accounting, the only accounting software Patriot Payroll integrates with besides QuickBooks Online, starts at $20 per month.

- Patriot sells time and attendance software as a separate product that starts at $6 per month + $2 per employee.

- Patriot’s separate HR software product, which includes expanded HR reports and manager permissions, starts at $6 per month + $2 per employee.

QuickBooks Online Payroll vs. Patriot Payroll: Feature comparison

Payroll processing and tax service

Winner: Tie

Both QuickBooks Payroll and Patriot Payroll calculate paychecks for hourly workers, salaried workers and contractors. They also calculate payroll taxes, including the following:

- Federal, state and local income taxes for employees.

- FICA taxes (Social Security and Medicare taxes), including the employee’s portion of the taxes and the employer’s matched contribution.

- The FUTA tax (federal unemployment tax), which is paid by employers only and is based on the number of employees you have.

All three QuickBooks Payroll plans include automatic tax service, as does Patriot’s full-service plan.

Local tax filing isn’t available with QuickBooks Payroll’s cheapest plan, QuickBooks Payroll Core. However, only QuickBooks has an autopilot feature that enables you to create a pre-set schedule for your payroll runs (though it’s only available for paying salaried employees).

Direct deposit

Winner: QuickBooks Payroll

Both of Patriot Payroll’s plans include two-day direct deposit, but only for certain qualifying customers. (Unfortunately, Patriot’s website doesn’t explain which customers qualify or why.) Meanwhile, QuickBooks’ cheapest plan, Payroll Core, comes with free next-day direct deposit. Its two higher-tier plans have same-day direct deposit.

QuickBooks charges an additional fee for contractor direct deposit, but there are no fees for paying salaried or hourly employees via direct deposit.

Employee benefits and benefits administration

Winner: QuickBooks Payroll

With Patriot Payroll, users can manually set up payroll deductions for employee benefits. Patriot also integrates with workers’ compensation insurance at no additional fee (unlike QuickBooks, which charges extra for integration). And while Patriot doesn’t offer 401(k) plans, it does offer free 401(k) integration for easier deductions.

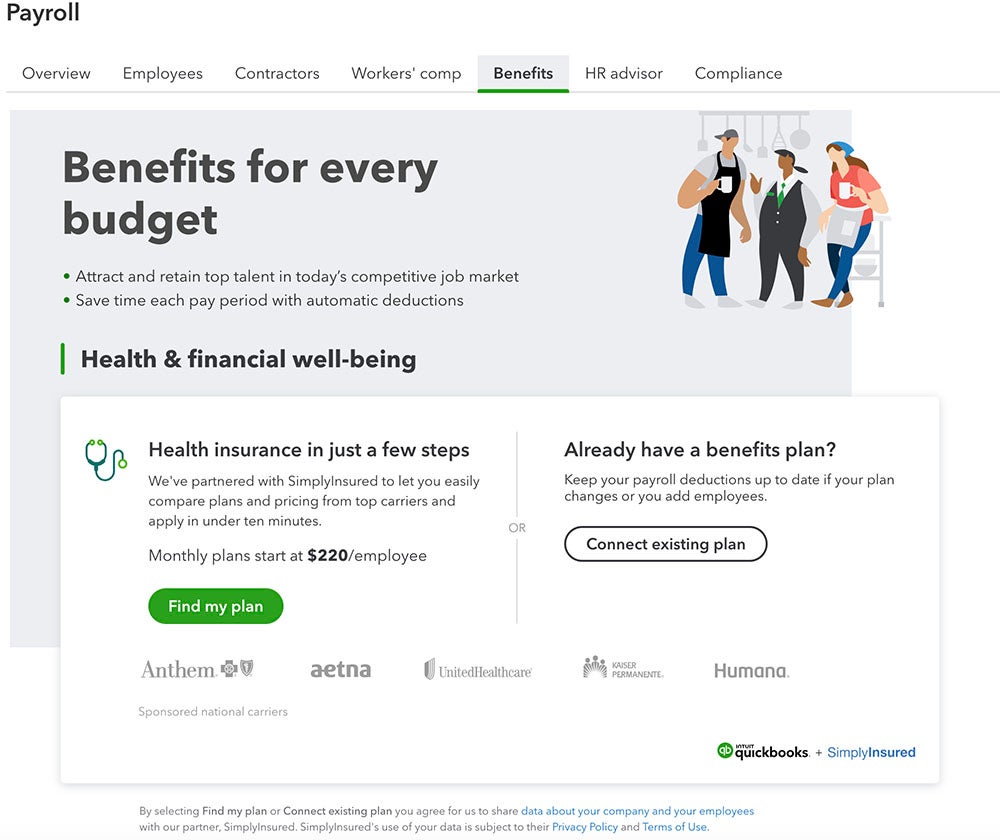

In contrast, QuickBooks Payroll enables automatic employee benefit administration (admittedly for an additional fee). It also partners with insurance providers to help business owners find affordable, comprehensive employee benefits directly from their payroll dashboard.

Customer service

Winner: Patriot Payroll

Of the two payroll providers, only QuickBooks Payroll has 24/7 customer service. Patriot’s customer service is available 9 a.m. to 7 p.m. ET over the phone. But on nearly every review platform, users call out Patriot’s excellent customer service department, noting its fast response times, friendly agents and real-person support.

In contrast, QuickBooks is notorious for its low customer service ratings. Customers report having a hard time getting in touch with a real person, much less getting helpful support as needed.

QuickBooks also staggers its customer support levels based on which plan you choose: Payroll Core users can only access basic customer service while Payroll Elite users get top-notch customer care. Payroll Core users don’t have the option of paying extra for better customer service, which is another point of frustration for some users.

Time and attendance tracking

Winner: Tie

Some payroll companies, like Gusto and SurePayroll, sync with multiple third-party time trackers so users can choose their preferred tool at their preferred price. However, QuickBooks Payroll and Patriot sync only with QuickBooks Time (QuickBooks Payroll and Patriot) or Patriot Time & Attendance (Patriot only).

While both time-tracking tools are perfectly functional, it’s frustrating that users can’t choose the time tracker that best suits their needs. Plus, Patriot Time & Attendance costs an additional monthly fee ($6 per month) and employee fee ($2 per employee). Meanwhile, QuickBooks Time is only free for higher-tier QuickBooks Payroll plans. QuickBooks Payroll Core users have to pay a separate subscription fee to use QuickBooks Time, which starts at $20 a month.

QuickBooks Online Payroll pros and cons

Pros of QuickBooks Online Payroll

- Seamless integration with QuickBooks Online Payroll and QuickBooks Time.

- User-friendly software.

- Multiple plans for enhanced scalability.

- Below-average per-payee fees keep costs lower.

Cons of QuickBooks Online Payroll

- Extremely limited third-party integrations.

- Some key features unavailable with cheapest payroll plan, such as time tracking and local tax filing.

- Fewer HR features than top competitors like Paychex, ADP and Gusto.

- Additional fees for employee benefits integration.

Patriot Payroll pros and cons

Pros of Patriot Payroll

- Extremely affordable full-service and self-service plans.

- Optional 401(k) and workers’ compensation insurance integration.

- Fast two-day direct deposit for qualifying customers.

- U.S.-based customer service with extended customer support hours.

Cons of Patriot Payroll

- Third-party integrations limited to QuickBooks Online only.

- Additional fee for time-tracking integration.

- No employee benefits add-ons or employee benefits administration.,

- Extremely limited HR features, even with Patriot’s standalone HR software product.

Our methodology

To evaluate QuickBooks Online Payroll and Patriot Payroll, we set up free trial accounts with both providers so we could explore their interfaces, features and setup processes firsthand. We also read verified customer reviews from review sites like Trustradius, Apple’s App Store, Google Play and Gartner.

While conducting our research, we scored both products according to our internal algorithm, which ranks payroll software in the following weighted categories:

- Pricing (weighted to 25%), which evaluates factors like highest and lowest pricing tiers, add-on fees and free trials.

- Payroll features (weighted to 35%), which evaluates essential payroll features like time-tracking integration, payroll reports, direct deposit, on-demand pay and more.

- Ease of use (weighted to 15%), which evaluates factors like mobile access, setup processes and interface design.

- Customer service (weighted to 15%), which evaluates factors like customer service hours, modes of contact and response times.

Our expert’s opinion and hands-on experience with the payroll software makes up the final 10% of our algorithm.

Should your organization use QuickBooks Online Payroll or Patriot Payroll?

QuickBooks Payroll and Patriot Payroll work equally well for businesses that need easy, cloud-based payroll processing services. Both services have free two-day direct deposit to ensure your employees get paid on time, every time. Depending on the plan you choose, both payroll companies will calculate, deduct and remit your employees’ federal, state and local taxes.

If you’re not sure which product will work best for your company, we recommend signing up for a 30-day free trial with both providers. (Just remember to cancel your QuickBooks Payroll account before your 30 days are up if you don’t want to be charged automatically for the next month.)

Try QuickBooks Online Payroll if . . .

- You already use Intuit QuickBooks Online and are comfortable with QuickBooks’ interface, setup and customer service.

- You want a payroll software provider that offers and integrates with employee health insurance benefits.

- You want the option to scale up to more intensive plans as your company grows.

Try Patriot Payroll if . . .

- You’d prefer to save money with an affordable and accurate self-service payroll tool.

- You pay only contractors and don’t need employee benefits, or else you don’t mind managing employee benefits with a separate software tool.

- Your top priority is finding functional payroll software that won’t cut too deeply into your bottom line.

Top alternatives to QuickBooks Payroll and Patriot Payroll

Of course, QuickBooks Payroll and Patriot Payroll are far from the only payroll options for small and midsize businesses. If neither provider suits your preferences, we recommend looking into one of the following comparable solutions:

- Gusto ($45 + $6/payee) is one of the most popular payroll software for small businesses. It integrates with far more third-party apps than either Patriot or QuickBooks, and it has more built-in HR features as well. Its brokerage supports employee health benefits in 37 states, which integrate with Gusto for no additional fee.

- SurePayroll ($19.99 + $4/payee) is one of the few payroll providers whose price compares to Patriot’s. Like Patriot, SurePayroll has a self-service and full-service plan. Unlike Patriot, it offers employee benefits in all 50 states, includes multiple free time-tracking integrations and has free two-day direct deposit for all customers.

- Rippling (unlisted base fee + $8/payee) is a unique company that offers payroll, HR, financial management and IT management. Unlike Patriot or QuickBooks, its packages are entirely customizable and can include as many or as few features as you need. Rippling also offers an optional PEO plan and Employer of Record service, and its international payroll feature supports both contractor and employee payments across the globe.

Read next: The 8 Best International Payroll Services for 2023

Source of Article