SurePayroll is a more affordable small-business payroll software than Gusto, while Gusto offers more HR tools, reporting and integrations to compensate for the higher cost. To help you figure out if you should save money with SurePayroll or invest in Gusto’s more extensive features, we compare the platforms head-to-head on all their most important features.

| SurePayroll | Gusto | |

|---|---|---|

| Starting price | $19.99 per month + $4 per employee per month | $40 per month + $6 per employee per month |

| Automatic payroll | Yes | No |

| Unlimited payroll runs | Yes | Yes |

| Benefits administration | Add-ons available | Health insurance included, other add-ons available |

| Additional HR tools | No | Yes |

| Reporting | No | Yes |

| Integrations | ~10 | 190+ |

| Visit SurePayroll | Visit Gusto |

SurePayroll vs. Gusto: Pricing

SurePayroll

SurePayroll offers two affordable and transparent pricing plans for small businesses:

- No Tax Filing: $19.99 per month + $4 per employee per month.

- Full Service: $29.99 per month + $5 per employee per month.

Additional services listed below are available for a fee — contact the sales team for a pricing quote:

- HR management.

- Health insurance.

- Low-fee 401(k) options.

- Pre-employment screening.

- Worker’s compensation.

Read the full SurePayroll review for more information.

Gusto

SurePayroll offers two transparent pricing plans, plus an enterprise plan with a custom pricing structure:

- Simple: $40 per month + $6 per employee per month.

- Plus: $80 per month + $12 per employee per month.

- Premium: Contact the sales teams for a custom quote.

Additional services listed below are available for a fee — contact the sales team for a pricing quote:

- Worker’s compensation.

- HSAs and FSAs.

- Life and disability insurance.

- 401(k) retirement savings.

- Commuter benefits.

- R&D tax credit services.

Read the full Gusto review for more information.

SurePayroll vs. Gusto: Feature comparison

Payroll

SurePayroll comes with unlimited payroll runs as well as the option to schedule your payroll to run automatically. It also comes with a free two-day direct deposit, although you must meet certain criteria to get next-day or same-day deposit. You can set multiple pay rates and bonuses within the payroll software to ensure that each employee’s wages are accurate. You can also generate online paystubs for employees to view. Both of SurePayroll’s plans come with live payroll help in case you get stuck and need assistance.

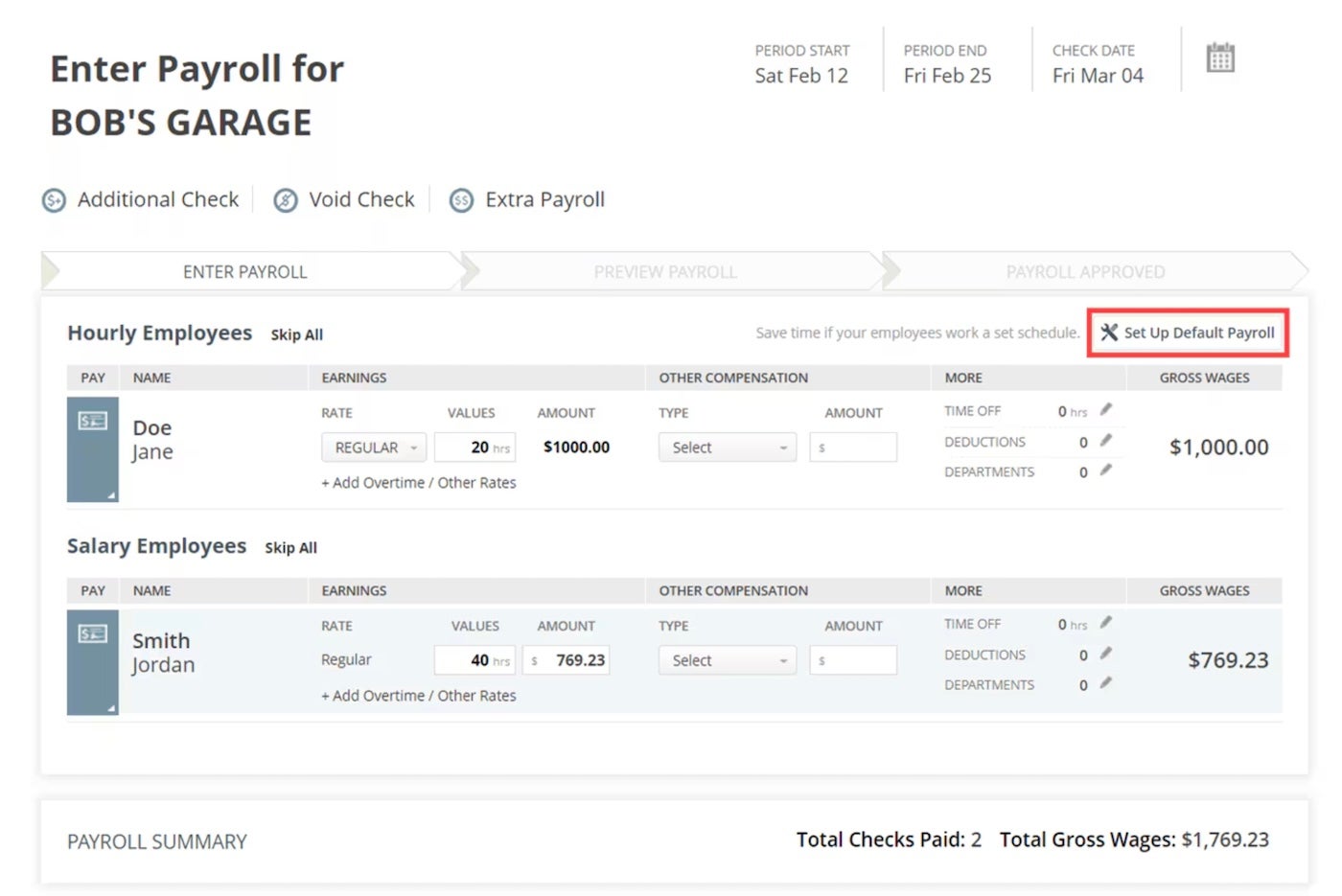

Gusto also offers unlimited payroll runs, including unlimited bonus and off-cycle payrolls, as well as an auto payroll feature. Gusto also offers a native time tracking feature, which makes it very easy to flow hourly data directly into payroll to ensure that all payments are accurate. You can also set multiple pay rates and multiple pay schedules and run payroll in all 50 states if necessary (though you’ll have to upgrade to the Plus plan for multi-state payroll software).

Next-day direct deposit is available, although same-day payroll is not. Gusto also offers a debit card option, so employees can get their cash more quickly without having to fuss with payment checks.

Taxes and compliance

SurePayroll will automatically calculate your payroll taxes, no matter which pricing plan you opt for. However, if you want SurePayroll to file and deposit your taxes, then you’ll need to upgrade to the Full Service plan. Subscribers for that plan can rest easy knowing that SurePayroll will take care of filing and depositing all federal, state and local taxes, as well as year-end tax filings. SurePayroll will also prepare all W-2, 1099, 940 and 941 forms for you.

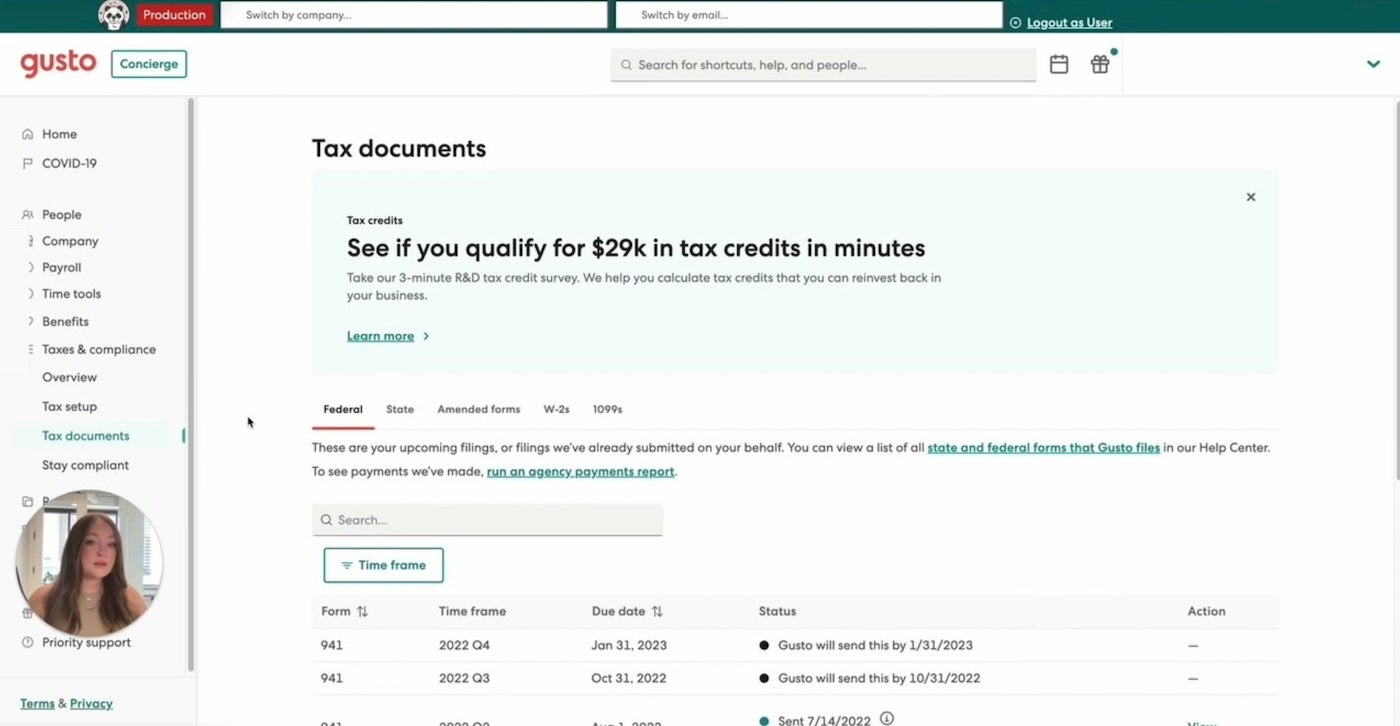

Gusto will also automatically calculate filing and deposit your taxes at the federal, state and local levels. The Simple plan supports full-service payroll in a single state, and you’ll need to upgrade to the Plus plan if you need to run payroll and file taxes in multiple states. Note that state tax registration costs an extra fee, no matter what pricing plan you are on. Gusto will also file your W-2s and 1099 forms and also send them to your employees and contractors so they have copies on file as well.

Benefits

SurePayroll offers optional paid add-ons for benefits administration. The pricing is not disclosed, so you’ll need to contact the sales department to get a pricing quote. SurePayroll is partnered with Paychex’s insurance agency, which helps you find health insurance plans that fit your company’s size and needs. It also offers low fee 401(k) retirement plans as well as worker’s compensation insurance through a partnership with CoverWallet (worker’s comp is not currently available in North Dakota, Ohio, Washington or Wyoming, however).

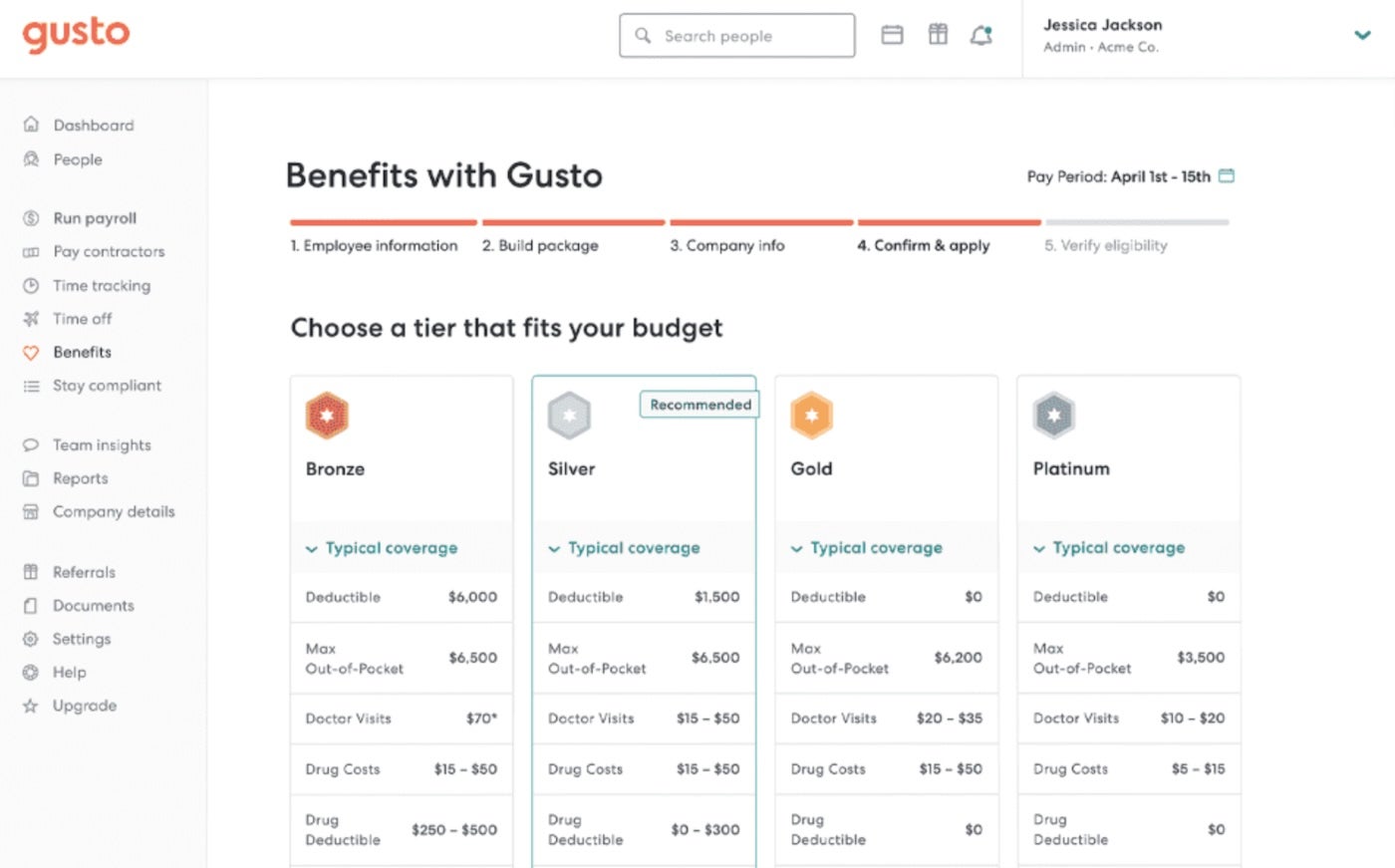

Health insurance administration is included with all of Gusto’s plans, although it’s only currently available in 38 states plus Washington, D.C. If you want to integrate your existing broker into Gusto, you’ll have to upgrade to the Plus plan and also pay an add-on fee, or go for the Premium plan. Gusto also offers paid add-ons for worker’s compensation, HSAs and FSAs, life and disability insurance, 401(k) retirement plans and even commuter benefits.

HR features

Up until now, SurePayroll and Gusto may have sounded pretty similar, but when it comes to additional HR features, the two platforms really start to diverge. Besides the benefit add-ons, SurePayroll does not really offer anything in terms of HR tools. Meanwhile, Gusto offers many different HR features depending on the pricing plan you choose.

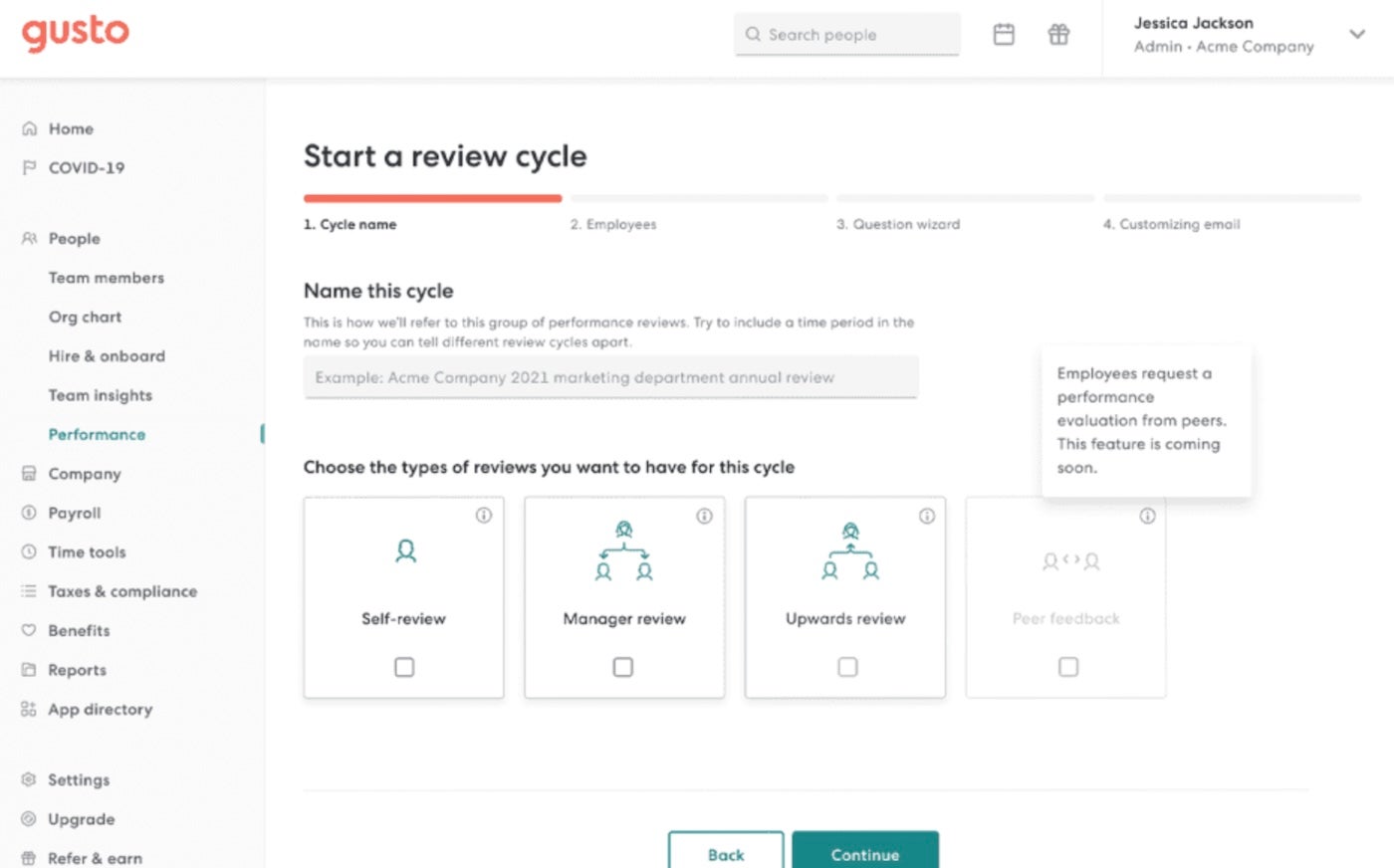

Some of the HR tools that you will get in Gusto include time tracking, PTO management, hiring and onboarding support, and performance reviews and development. Gusto also provides templates for job posts and offer letters to help you speed up the hiring process, although it does not provide a full applicant tracking system, unlike some other platforms. If you need these additional HR features and want to keep it all within a single platform, then you should choose Gusto over SurePayroll.

Reporting

Gusto also offers much more robust reporting and analytics when compared to SurePayroll, which is more limited in this department. SurePayroll does offer a handful of reports, including pay stubs, benefits, new hires and year-to-date reports. However, there isn’t an option to create and save a custom report.

Gusto provides multiple preloaded reports to choose from, including bank transactions, general ledgers, expenses, time off balances, workforce costing and more. You can also build your own custom report and save it for later if none of the prebuilt reports meet your needs. Certain reports can also be summarized by department, so you can see how your various teams are performing across the entire organization.

Integrations

Another big difference between SurePayroll and Gusto is the number of integrations available. SurePayroll’s integrations are very limited, and the only available options are a time clock integration and a handful of popular accounting software such as QuickBooks and Xero. Meanwhile, Gusto offers almost 200 prebuilt integrations for everything from Asana to Slack to Google Workspace. If you need your payroll software to integrate with the rest of your business software stack, Gusto is also the better choice to make.

SurePayroll pros and cons

Pros of SurePayroll

- More affordable than Gusto.

- Smaller learning curve than Gusto.

- Integrates with popular accounting platforms.

- Mobile apps are well-reviewed.

Cons of SurePayroll

- HR tools are more limited than Gusto.

- Reporting and analytics could be improved.

- Could offer more integrations.

Gusto pros and cons

Pros of Gusto

- Time tracking included on Plus plan.

- HR tools for hiring, onboarding and performance.

- Includes many pre-built reports

- Nearly 200 integrations to choose from.

Cons of Gusto

- More expensive than SurePayroll.

- Learning curve is higher due to the number of features.

- Some HR tools are limited to the most expensive plan.

Should your organization use SurePayroll or Gusto?

Choose SurePayroll if . . .

- You’re looking for a more affordable payroll platform.

- You don’t need many additional HR tools.

- You don’t want reporting and analytics.

- Your integration needs are very limited.

Choose Gusto if . . .

- You’re willing to pay more for more features.

- You want HR tools that integrate with your payroll.

- You need more advanced reporting and analytics.

- You want to be able to choose from many integrations.

Methodology

To compare SurePayroll and Gusto, we consulted product documentation and user reviews. We considered features such as payroll, benefits administration, HR tools, reporting and integrations. We also weighed other factors, such as the customer service available, the difficulty of the learning curve and the user interface design.

Source of Article