Wagepoint: Fast factsMonthly pricing: $20 + $2 per employee (CAD) Key features:

|

Wagepoint’s affordable, efficient payroll software handles direct deposit, workers’ compensation administration and fee-free tax remittance. Its simplicity and low starting price make it ideal for small businesses in Canada that want fully automated payroll with useful integrations — and nothing more.

If your midsize business or enterprise needs more robust HR payroll software with built-in workforce and talent management tools, we recommend a Wagepoint competitor like Ceridian Dayforce or ADP. But if all you need is a streamlined software solution to pay employees effortlessly and affordably, Wagepoint is a solid choice.

In our Wagepoint payroll review below, find out more about whether Wagepoint or a competitor makes more sense for your company.

Jump to:

Featured partners

Pricing

Wagepoint costs $22 (CAD), which includes a base fee of $20 per month plus $2 per employee paid. Wagepoint’s base fee seems to be charged monthly while its per-employee fee seems to be charged weekly, but the site’s cost calculator is broken. (Its chatbot can only refer you to the calculator instead of offering an upfront cost.)

Wagepoint has just the one plan with the one base fee, which makes costs easy to calculate (as long as the calculator is working, that is). Small businesses on a budget will appreciate Wagepoint’s simple, transparent payroll costs, though bigger businesses — as well as midsize businesses planning for more growth — will likely prefer software with multiple plans for scalability.

While Wagepoint doesn’t offer a free trial, it allows you to create a free account without requiring you to enter your credit card details. If you decide Wagepoint is right for you, you won’t be charged until your first payroll run.

Wagepoint key features

While Wagepoint has historically offered a payroll service for U.S. businesses, its U.S. service has been temporarily paused. For now, Wagepoint serves small businesses in Canada only. As a result, the following features apply to Wagepoint Canada. We’ll update this piece once Wagepoint’s U.S. payroll software is back online.

Automatic full-service payroll

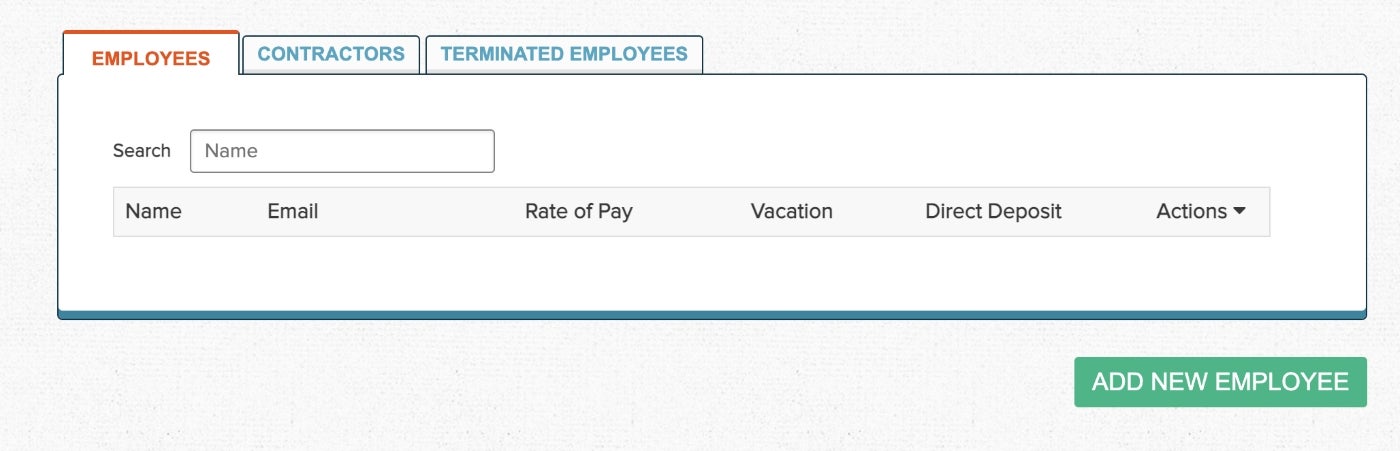

Wagepoint calculates your salaried and hourly employees’ gross pay, withholds the correct payroll taxes and remits those taxes to the appropriate agency at no additional fee. Employees can use Wagepoint’s self-service portal to check their pay details and access their tax documents. Wagepoint talks you through the simple process of adding a new employee to payroll, tracking contractor pay and generating the correct records when employees are terminated (Figure A).

Figure A

Thorough tax remittance and reporting

Wagepoint’s software withholds and remits the following types of payroll taxes and paycheck contributions:

- Federal income tax.

- Territorial and provincial income tax.

- Canada Pension Plan.

- Québec Pension Plan.

- Local territorial and provincial taxes.

- Employment Insurance.

- Québec Parental Insurance Plan.

The software also generates end-of-year tax forms, including form T4 and form T4A.

Third-party integrations

Wagepoint has its own time-tracking and PTO management apps, but it also integrates with some of the most popular third-party accounting and time-tracking apps, including the following:

- QuickBooks Online.

- Xero.

- QuickBooks Time (formerly Tsheets).

- 7shifts.

- Slack.

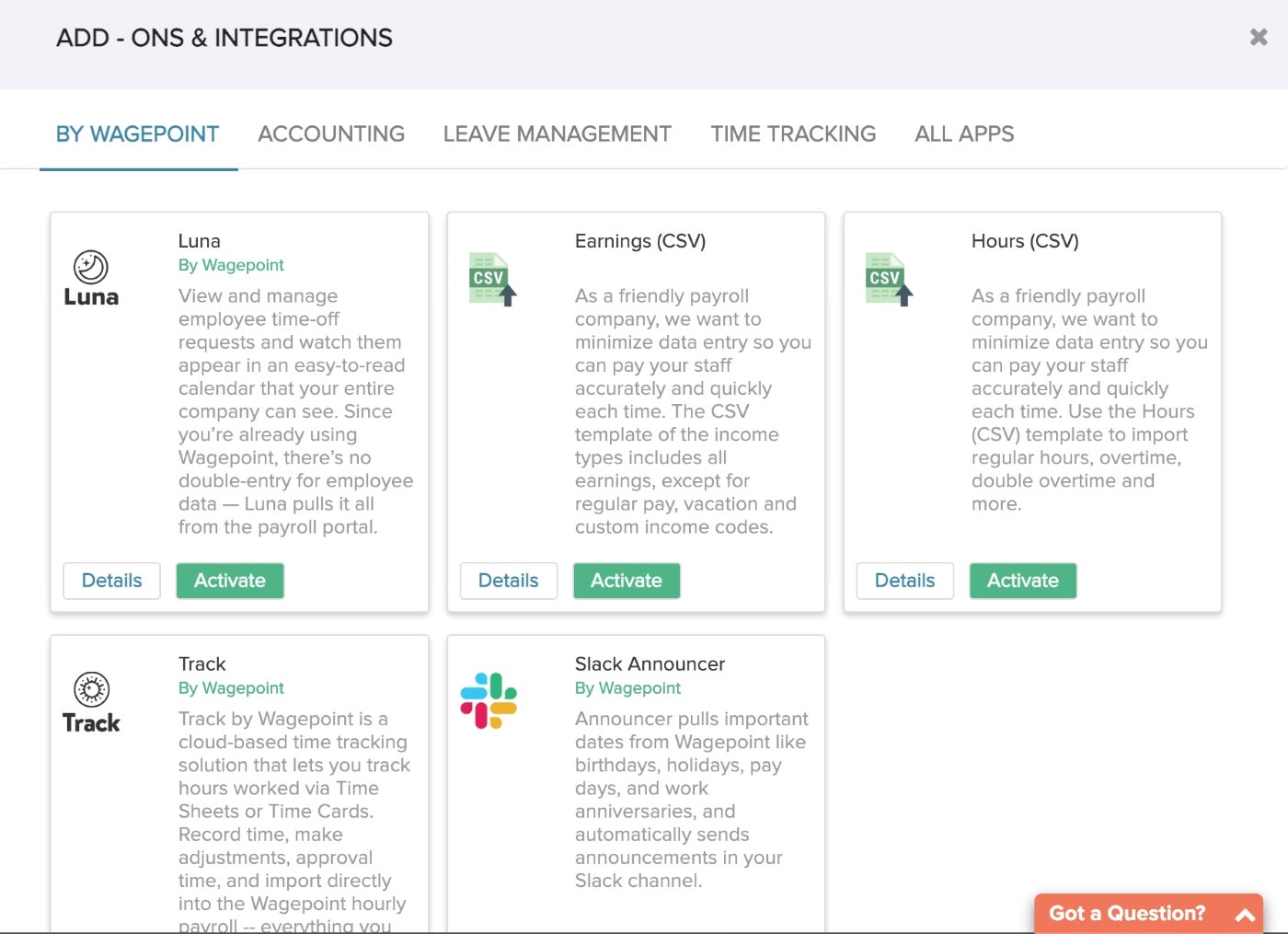

Wagepoint users can easily add and activate integrations from their dashboard (Figure B).

Figure B

Wagepoint pros

User-friendly setup

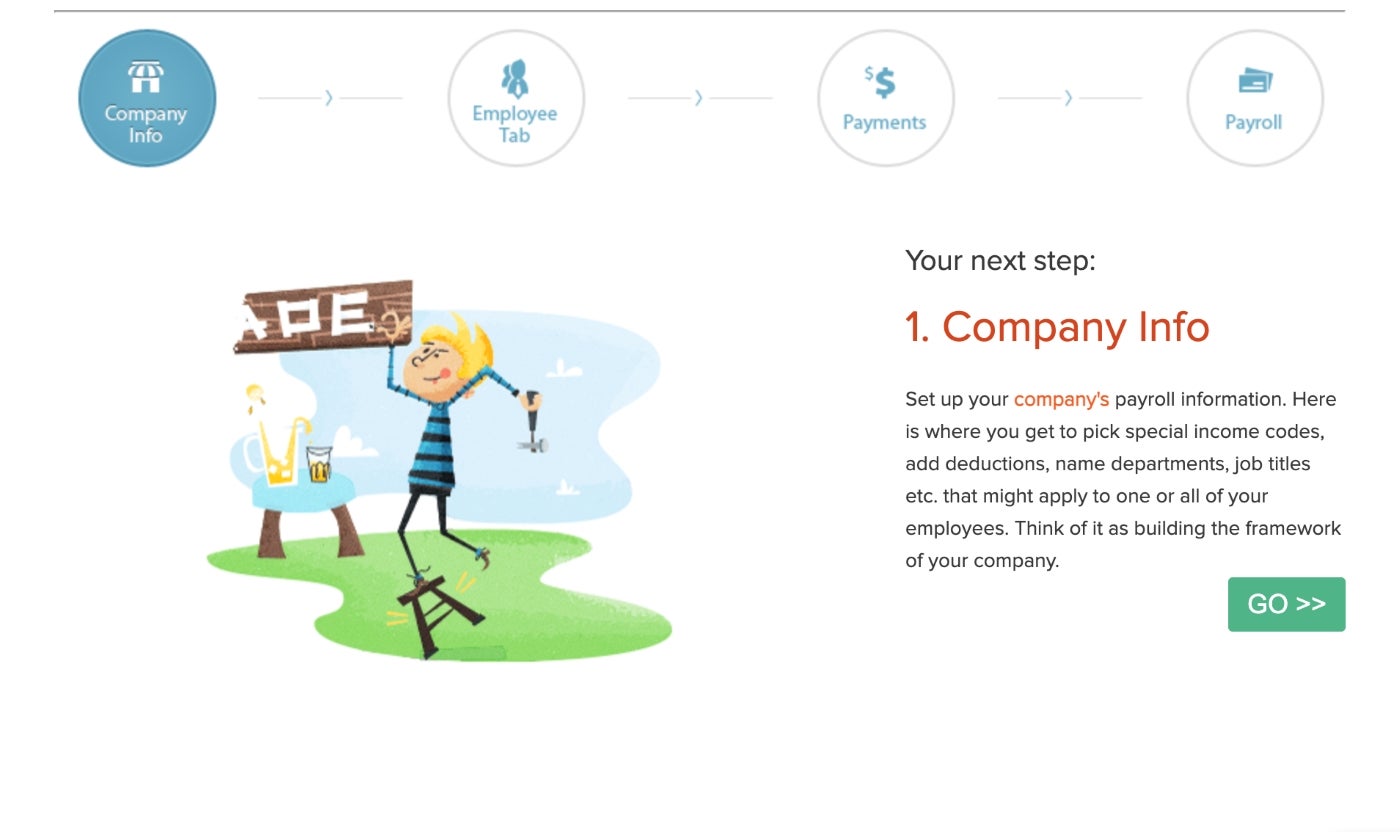

Wagepoint’s setup wizard simplifies payroll from the get-go with clear instructions and friendly graphics. The software walks you through adding your business information, employee information, bank details and tax information. From there, all you have to do is hit a button to pay employees, generate reports and remit taxes (Figure C).

Figure C

Positive customer service reviews

Although Wagepoint’s customer service team only operates during regular business hours, it generally receives glowing reviews from customers who are happy with Wagepoint’s level of support.

After submitting a ticket from your dashboard, you can typically expect a response within 24 hours. Its knowledge base and on-demand webinars help business owners get comfortable with payroll processing generally and Wagepoint’s software in particular.

Affordability

Wagepoint’s starting base price of $20 is well below average for full-service payroll software, and its $2 per-employee fee is also notably low. Of course, Wagepoint’s low price means the software comes with fewer features than more comprehensive, more expensive competitors, but Wagepoint’s small-business-friendly starting price makes it an affordable entry point for first-time employers.

Wagepoint cons

Limited accounting software integrations

Wagepoint only integrates directly with QuickBooks Online and Xero. If you use a different accounting software brand, you can export your payroll and time-tracking data as a CSV file and upload it. However, this method requires more manual data entry, oversight and time than an automatic integration would.

Poor PTO and time-tracking tools

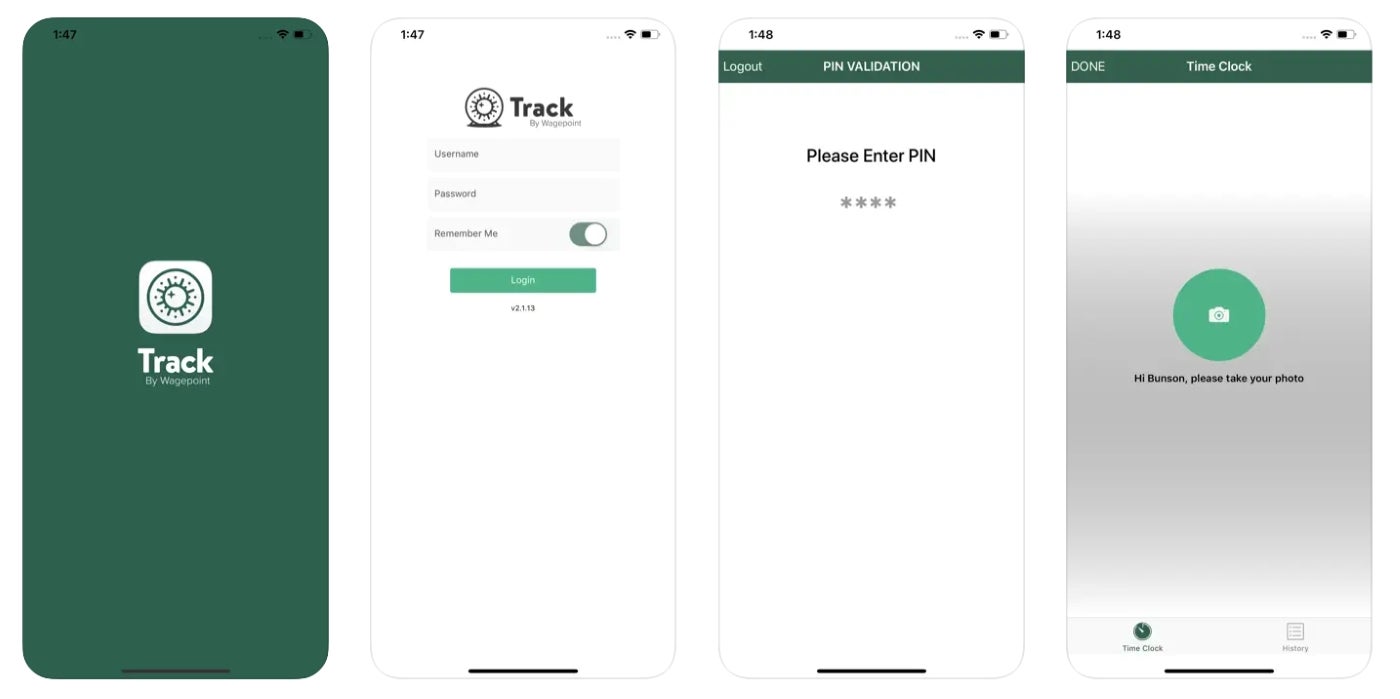

Wagepoint has its own PTO management system called Luna and a time-tracking tool called Track. Neither app is fully functional — in fact, although the company still advertises its apps, they have extremely limited App Store reviews and no Google Play reviews (Figure D). Assuming the apps are usable, each Wagepoint app costs an additional fee to integrate.

Figure D

No HR tools or HCM-adjacent features

Most standalone payroll software — even payroll-first software like Gusto — includes at least a handful of HR or HCM features. In contrast, Wagepoint focuses solely on payroll with no supplementary onboarding tools, HR library access or HR-specific compliance help.

No mobile payroll app

If you use Wagepoint to process payroll, you’ll have to do so from your laptop or desktop computer. Wagepoint doesn’t offer a mobile payroll app for employers who want to run payroll on the go, or employees who want to check their pay information from their phones.

Top Wagepoint alternatives

RUN Powered by ADP

ADP’s payroll solutions for small businesses include fully outsourced HR in the form of a professional employer organization. If you need a less thorough payroll solution, RUN Powered by ADP is the company’s flagship payroll product. It has well-reviewed payroll apps for both employers and employees. Along with processing payroll and remitting taxes, ADP’s payroll software gives employers access to HR tools like onboarding tools, HR templates and other resources.

Pros:

- User-friendly apps and online interface.

- Multiple plans for scalability.

- HR tools included with each payroll plan.

Cons:

- More expensive than competitors like Wagepoint.

- Potentially high software learning curve.

Pricing: Contact for quote.

Ceridian Dayforce

Ceridian Dayforce is one of the most popular Canadian payroll programs. In contrast to Wagepoint and RUN Powered by ADP, it goes beyond payroll to offer a comprehensive human capital management solution. Along with paying employees, businesses use Dayforce to manage their workforces, engage with employees and find top talent in any industry.

Pros:

- Thorough third-party integration.

- Comprehensive workforce management features.

- Totally automated payroll.

Cons:

- Expensive starting price.

- Less customizable than some HCM options.

Pricing: Contact for quote.

Is Wagepoint right for your business?

If you own a small business in Canada, want payroll software that tackles the basics of employee pay and prefer an online interface to a mobile app, Wagepoint could be a good fit for you. Thanks to its affordability, Wagepoint is a solid introductory payroll service for businesses that just hired employees for the first time.

But if you’re part of a midsize business or enterprise — or if you own a small business but want more comprehensive HR tools and customer service — Wagepoint doesn’t have enough tools, features or integrations to support you. Look into enterprise-level payroll or HCM software like Paycom or ADP instead.

How we evaluated Wagepoint

To evaluate Wagepoint, we signed up for a free trial to test-drive its software. We set up an account, added business details and tested Wagepoint’s payroll runs. Along with doing our own hands-on testing, we reviewed verified Wagepoint user reviews on aggregate review sites, including Gartner Peer Insights, Trustpilot, the Better Business Bureau and the App Store.

To guide our research, we focused on Wagepoint’s strengths and weaknesses in the following key areas:

- Overall payroll and HR features.

- Pricing, including the software’s base costs, per-employee costs and add-on fees.

- Customer service, including the company’s engagement with customer complaints, its customer support hours and its methods of communication.

- User-friendliness, including the software’s online interface, mobile app and overall accessibility.

Source of Article