Both TriNet Zenefits and Rippling make easy-to-use payroll and HR software, but they cater to slightly different audiences. In this guide, we compare Zenefits vs. Rippling to help you decide which cloud-based HR solution is right for your business.

Jump to:

Featured partners

Zenefits vs. Rippling: Comparison table

| Features | ||

| Global payroll | ||

| Time and attendance | ||

| Performance management | ||

| Compensation management | ||

| Employee engagement | ||

| Learning management | ||

| Applicant tracking | ||

| PEO and EOR services | ||

| Starting price | ||

Zenefits vs. Rippling: Pricing

Zenefits pricing

In addition to a free trial, Zenefits offers three main pricing plans:

- Essentials: $8 per employee per month billed annually, or $10 per employee per month billed monthly.

- Growth: $16 per employee per month billed annually, or $20 per employee per month billed monthly.

- Zen: $27 per employee per month billed annually, or $33 per employee per month billed monthly (this plan includes payroll).

Zenefits also offers multiple add-ons:

- Payroll: $6 per employee per month.

- HR services: $8 per employee per month.

- Benefits admin using your own broker: $5 per employee per month.

- Recruiting: Starts at $62 per month.

For information, see our full Zenefits review.

Rippling pricing

Rippling’s website states that prices begin at $8 per employee per month, but it doesn’t disclose information beyond that. Each product (Payroll, Benefits, Device Management, etc.) can be purchased separately to create your own custom plan, so you only pay for the features your company needs. Contact Rippling’s sales team for a pricing quote.

For more information, see our full Rippling review.

Feature comparison: Zenefits vs. Rippling

Payroll

Zenefits offers a payroll add-on for two of its pricing plans — payroll is included in the highest-tier Zen plan. Zenefits payroll offers unlimited payruns, direct deposit, tips reporting, wage garnishments support, contractor payments and general ledger reporting. The platform will also automatically calculate and file payroll taxes on your behalf.

While Zenefits doesn’t disclose what countries it’s available in, its website makes it clear that it caters to businesses based in the United States, which contrasts with some other Zenefits competitors.

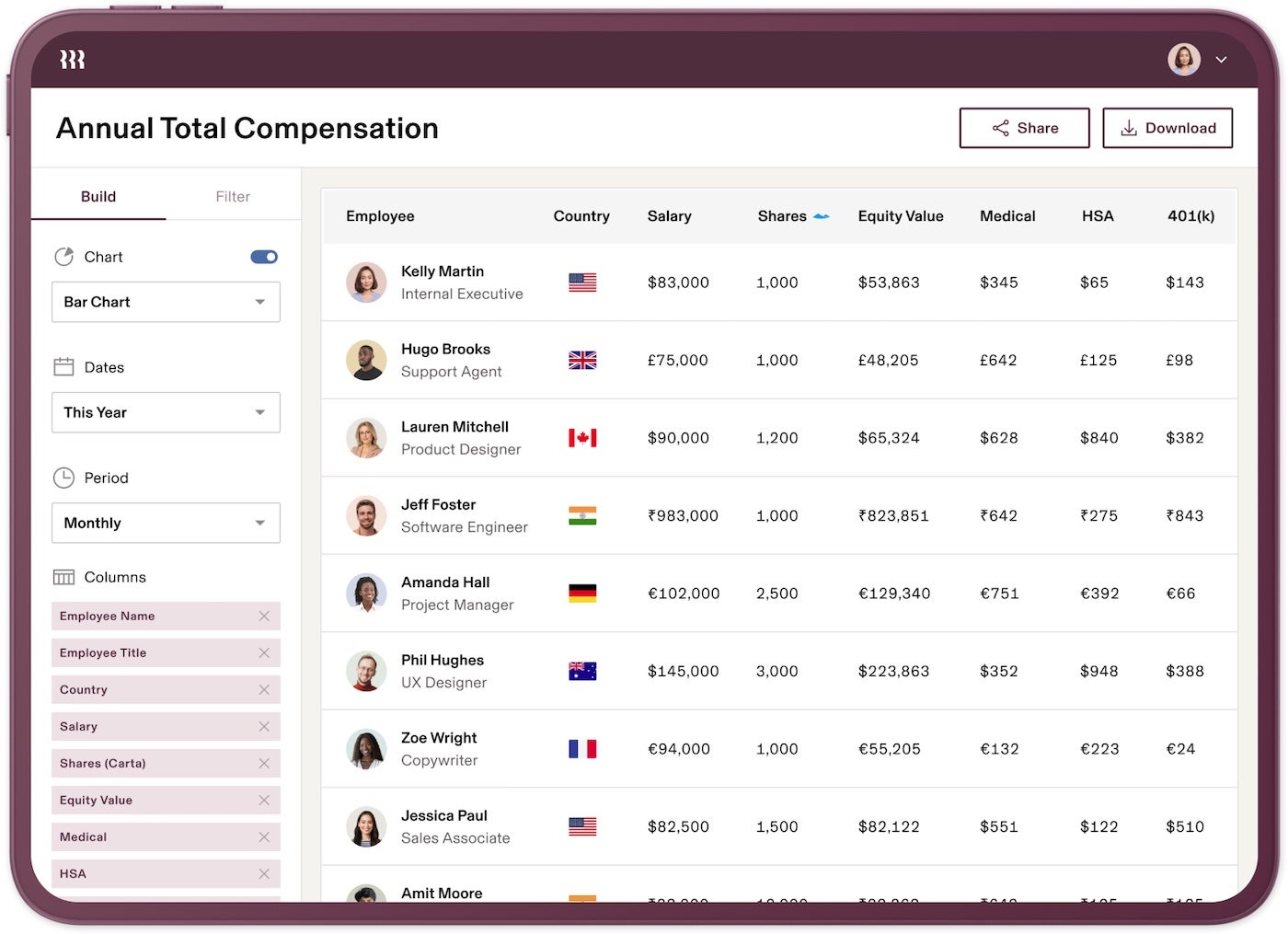

Figure A

Meanwhile, Rippling is very transparent about being a global payroll platform (Figure A) that’s available in 50+ countries. It also offers unlimited payroll runs as well as automatic payroll that can be run in as little as 90 seconds. Rippling also provides automatic tax filing as well as a mobile app so employees can view their pay stubs and W-2 forms on the go. It also automatically notifies users of compliance issues so they can follow local wage laws.

Benefits administration

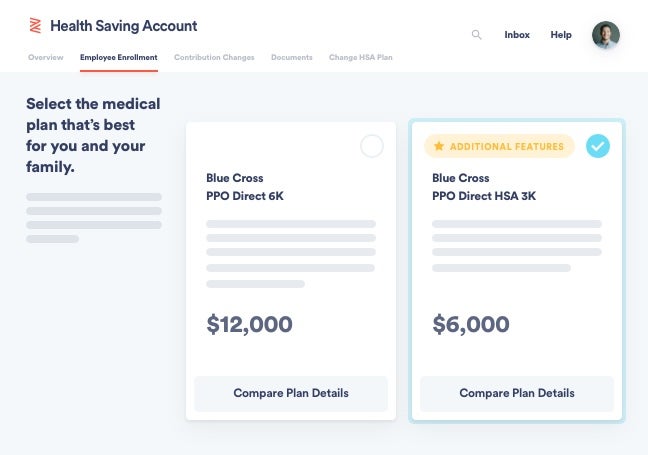

Figure B

Zenefits allows you to bring your own broker to the platform, or you can use Zenefits shop for medical, vision and dental plans in all 50 states. Zenefits also supports numerous other benefits, including HSA, FSA, 401K, life insurance, disability insurance, commuter benefits and supplemental benefits. The automated system helps companies stay compliant with ACA regulations and allows employers to self service (Figure B).

Rippling also combines all benefits together in one platform and gives you the option to get a referral or bring your own broker. In Rippling, users can shop for more than 4,000 plans from leading U.S. carriers, including Aetna, Humana and Blue Cross Blue Shield. Rippling automates the busywork with a huge collection of automation recipes, making it easy for HR to enroll new hires, update deductions and administer COBRA.

Other HR features

Both Zenefits and Rippling have rolled out various features over the past few years, which have made the two competitors closer than ever. For example, both platforms now offer tools for time and attendance, performance management, compensation management, employee engagement and results.

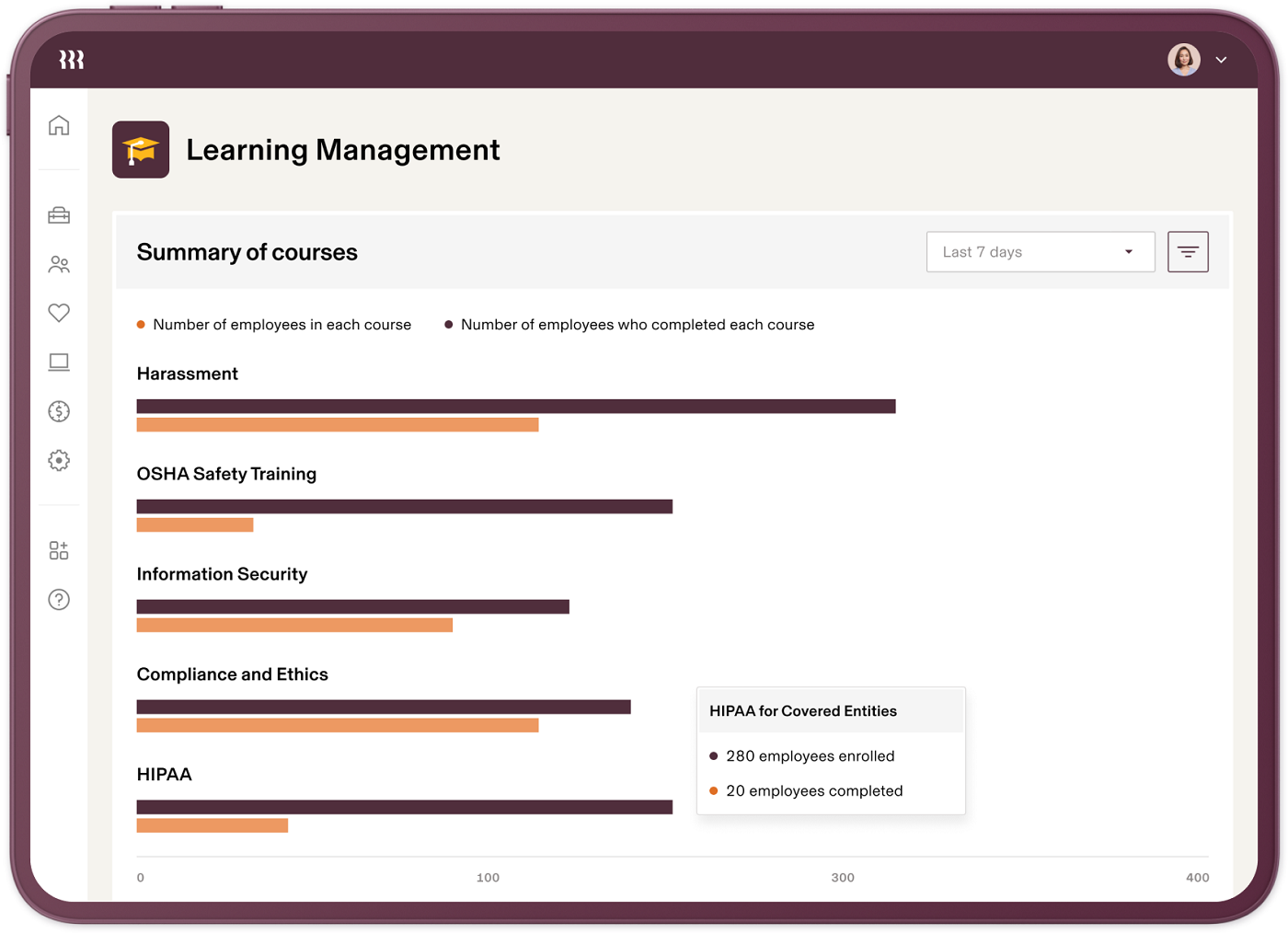

Figure C

However, there are still some key differences between them. For instance, Zenefits’ recruiting tools are an add-on powered by JazzHR, while Rippling’s applicant tracking system is native to the platform. Rippling also offers a learning management system (Figure C), while Zenefits doesn’t have an LMS at this time. Rippling even offers the option to add on finance and IT tools, which is something that distinguishes it from almost every other Rippling competitor.

HR services

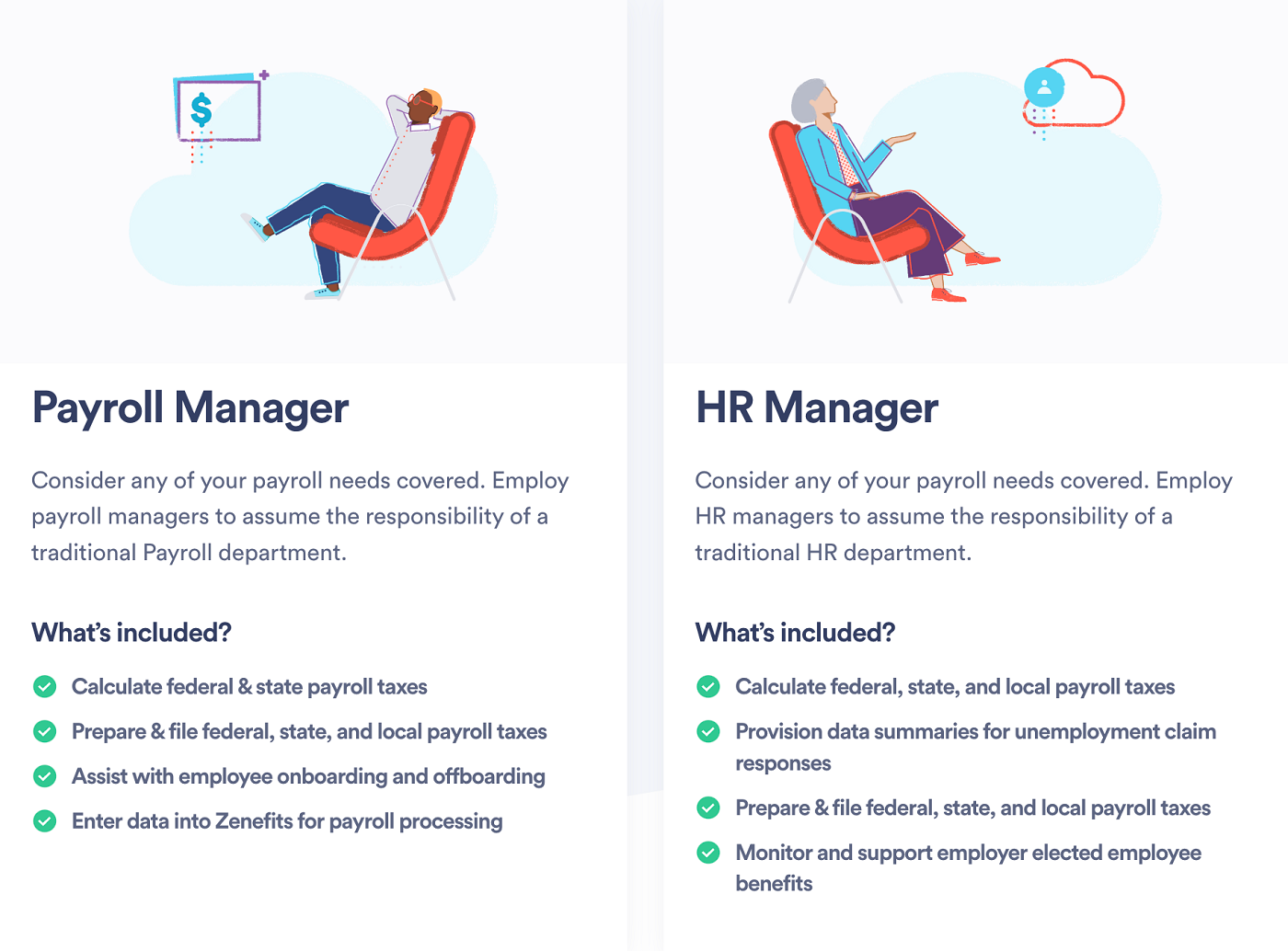

Figure D

Both Zenefits and Rippling offer expert assistance with payroll and HR matters, but on a different scale. Zenefits offers HR advisory and tax services that can help with issues such as calculating state taxes, monitoring employee elective benefits and auditing HR operations (Figure D).

In contrast, Rippling offers both professional employer organization (PEO) and Employer of Record (EOR) options for companies looking to hire either domestically or internationally. If you want someone to run payroll for you, or you need to hire someone in a country where you don’t have a legal entity, Rippling can help you out.

Zenefits pros and cons

Pros of Zenefits

- Affordable, transparent pricing.

- Free trial available.

- Easy-to-navigate user interface.

- Simple benefits administration.

Cons of Zenefits

- HR services are limited compared to Rippling.

- No learning management system available.

- Payroll platform is not global.

- Limited number of reports available.

Rippling pros and cons

Pros of Rippling

- Global, automated payroll platform.

- Learning management system available.

- Option to add finance and IT modules as well.

- PEO and EOR support available.

Cons of Rippling

- No free trial available.

- Pricing is not transparent.

- Steeper learning curve due to the higher number of features.

- Set-up can be time consuming.

Methodology

To compare Zenefits and Rippling, we consulted product documentation and user reviews. We considered factors such as user interface design, pricing plans, free trials and customer support. We also considered features such as payroll, benefits administration, performance management, employee engagement, compensation management and applicant tracking.

Should your organization use Zenefits or Rippling?

Zenefits caters to small and medium-sized businesses located in North America, and that shows in its feature and geographic concentration. If your business fits that description and is looking for easy-to-use payroll and HR software, then Zenefits is a great choice. Its free trial and completely transparent pricing plans will be especially appealing to small-business owners. It does offer limited HR support, but not a full-blown PEO or EOR service.

On the other hand, if you are a larger business looking to scale (especially internationally), then Rippling may be a better choice for you. Rippling has a much bigger international presence than Zenefits: Its payroll tool is available in more than 50 countries, and it offers both PEO and EOR services for companies that need hiring support. It also offers additional features — such as a learning management system, financial modules and IT tools — that larger businesses will benefit from.

Not sure if either Zenefits or Rippling is right for your needs? Check out our other recommendations for the best HR software and the best payroll software of this year.

Other human resources solutions

1 Deel

Deel’s full-suite of HR tools allows companies to manage the entire employee lifecycle—from recruitment and onboarding and beyond—in 150 countries. All this from a single, easy to use interface. US and Global Payroll allows you to pay any type of worker in 100+ countries, and all 50 states, in whatever currency you choose. And with 200+ in-house legal experts and entities in 120+ countries, using Deel means you’ll always be compliant with local regulations.

Source of Article