Valuation was developed by the co-founder of alternative capital firm Clearbanc, who spent six years on the Canadian version of “Shark Tank.”

Pinkypills, Getty Images/iStockphoto

Trying to figure out the value of a startup is critical, but it’s complicated and rarely done without raising funding from venture capitalists. Zillow built the technology to find out the worth of your home. Kelly Blue Book has done it for decades for cars.

Now Clearbanc, an alternative capital provider that specializes in helping startups, has launched an AI-based platform that lets startup founders know how much their company is worth—in 24 hours, for free.

Michele Romanow, co-founder and president of Toronto-based Clearbanc, said she got the idea for the platform during the six years she spent as an investor on the Canadian version of the TV show “Shark Tank.”

“We kept seeing all these entrepreneurs giving away huge portions of their company to buy growth,” she said. Romanow recalled a father and son who came on years ago with a cell phone case that cost them $10 to make and $10 in ad costs, and they were selling it for $50.

SEE: COVID-19 e-commerce bubble is inflating prices, Adobe finds

“They were looking for $100,000 for 20% of the company, and I remember thinking it was such a bad deal for both parties,” she said. Romanow ended up making a different deal with the father and son, giving them $100,000 and getting 5% of the revenue until they paid back the money and a 6% fee for her capital.

That gave the founders a chance to grow without having to give up control of their company, she said. “That effectively became the first Clearbanc deal.”

So far, the firm has invested more than $1 billion in over 2,800 e-commerce companies on the same principle: That founders shouldn’t be giving up equity for things that are repeatable in their business, Romanow said.

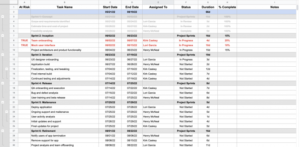

Clearbanc’s new tool, Valuation, lets founders plug in information including their online bank account, payment processor, ads account and their accounting platform. The more accounts connected, the more accurate the valuation, the company said.

Valuation uses AI and leverages an extensive data infrastructure to analyze a company’s position in the market, revenue trajectory, and potential for growth alongside competitors in the vertical, the company said.

Within 24 hours, companies receive a free valuation report based on current revenue, costs, cash on hand, market segment success and a comparison of the business to other businesses in the sector, Romanow said.

After receiving the valuation report, founders have the option to access growth capital, connect with investors to explore raising venture capital; meet buyers to explore selling the business; and take additional funding through Clearbanc’s 20-minute term sheet if they qualify.

Valuation was beta tested by thousands of companies over 18 months, the company said. The combined total value of the companies using the platform in beta is $32 billion. To date, Clearbanc has connected over 60 companies with VC investors.

Romanow said the e-commerce space has continued to grow and surge even during the pandemic. In the US, e-commerce as a percentage of retail sales spiked from 14% of retail sales to 28% in the first 12 weeks of COVID-19, she said.

“I think the risk [of starting an e-commerce business] is offset by sales that have come online,”‘ Romanow said. “Valuation is so relevant now because it’s harder to meet investors and get a sense of what a company would be valued at and that’s why a product like this is so much more valuable in this climate.”

Also see

Source of Article