| As of July 31, 2024, Intuit QuickBooks will no longer sell new subscriptions to its QuickBooks Desktop Pro Plus, Premier Plus, Enhanced Payroll or Mac Plus plans.

Current QuickBooks Desktop subscribers will be able to renew their subscriptions year over year, but all new sales will stop at the end of July 2024. So far, this product change applies solely to the United States. QuickBooks will continue to sell desktop software in the form of QuickBooks Enterprise only. |

Intuit QuickBooks is an incredibly well-known accounting software program used by companies worldwide. While QuickBooks Online might be the company’s most popular product, it isn’t the only one offered by Intuit. With multiple products — and multiple plans within those products — it can be hard to know which QuickBooks product is best for your business.

In my review, I found that QuickBooks Online is the best Intuit QuickBooks accounting product for most small, midsize and growing businesses.

However, QuickBooks Solopreneur can work well for individual business owners who want in-depth tax help while QuickBooks Desktop is a more robust option for bigger businesses with complex finances. Keep reading to learn more about the different types of QuickBooks products and find the accounting software that will work best for you.

QuickBooks accounting software comparison table

Plan and pricing information verified as of 3/7/2024.

*Annual subscription required. Listed starting price is for the first year of service only. Price increases after 12 months of service.

**Pricing varies based on your business’s average monthly expenses. Monthly fee is subject to reassessment at Intuit’s discretion.

QuickBooks Online: Best QuickBooks product for most businesses

Our star rating: 4.6 out of 5

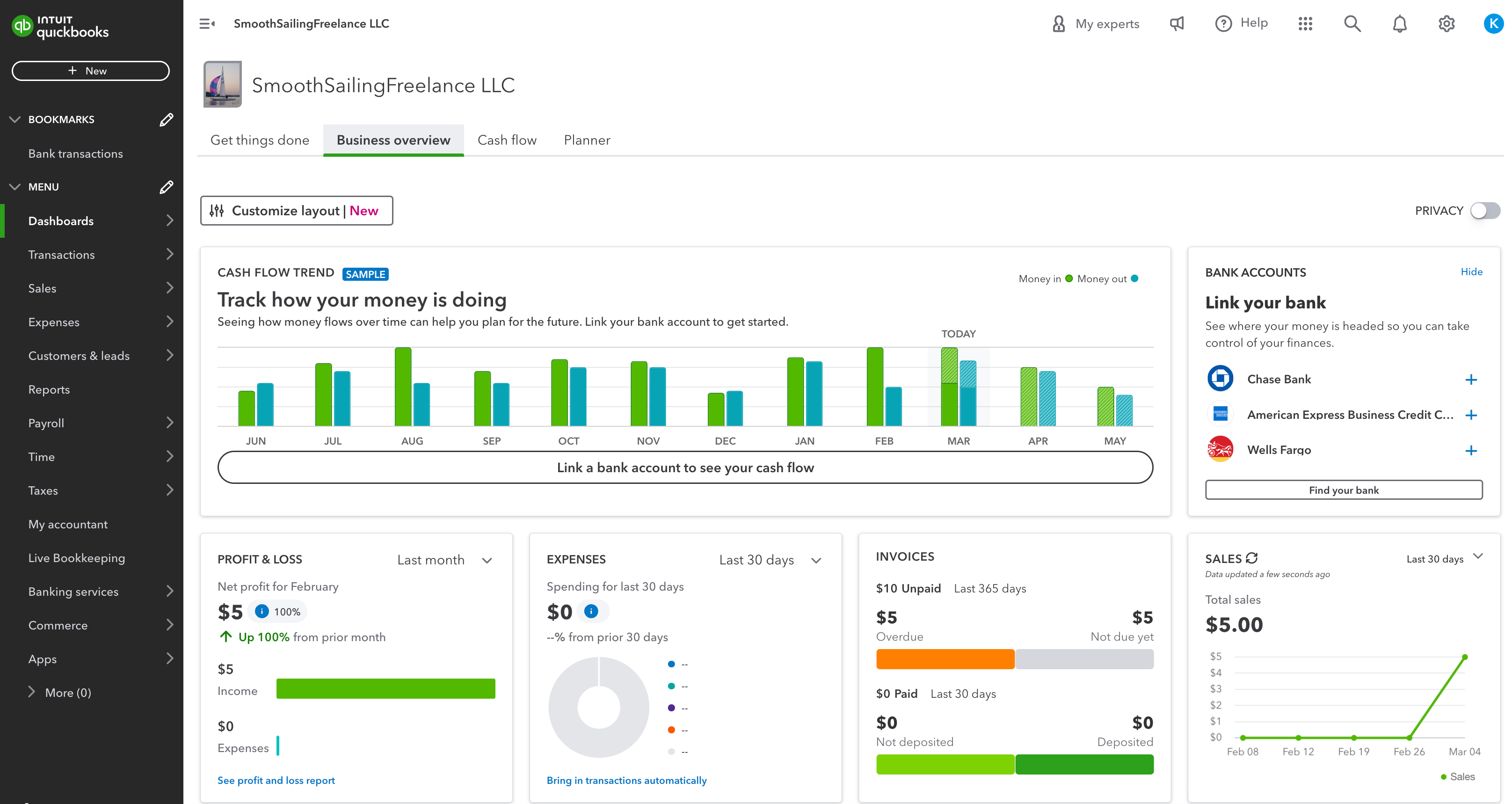

While QuickBooks Online is incredibly popular among accountants, it was primarily built to help non-accountant business owners manage their finances without an accounting degree. The user-friendly interface, straightforward setup and intuitive dashboard quickly get new business owners up to financial speed so they spend less time on bookkeeping.

As a cloud-based accounting software program, QuickBooks Online can be securely accessed from any web-enabled device. QuickBooks’ excellent mobile accounting app extends access to your phone — use it to snap receipts, upload expenses, check your finances, create mobile invoices and build estimates on the go.

For more information, read our full QuickBooks Online review.

Pricing

There are four QuickBooks Online plans, each with a different number of users:

- QuickBooks Simple Start: $30 per month. Includes access for one user.

- QuickBooks Essentials: $60 per month. Includes access for up to three users.

- QuickBooks Plus: $90 per month. Includes access for up to five users.

- QuickBooks Advanced: $200 per month. Includes access for up to 25 users.

New users can choose to test the software free for 30 days or opt to take 50% off for three months. Note that you’ll have to enter your payment information upfront and agree to scheduled autopayments. If you decide QuickBooks Online isn’t for you, make sure to cancel your free trial before the 30 days are up.

Features

Every QuickBooks Online plan includes these essential bookkeeping features:

- Cash flow tracking.

- Unlimited estimates, invoices, income and expense tracking and receipt scanning.

- 1099 contractor management.

- Customizable accounting reports.

- Connection to at least one sales channel (or unlimited channels with higher-tier plans) for easier automation and cash tracking.

- Built-in integration with over 750 third-party business apps through the QuickBooks app store.

Higher-tier QuickBooks Online plans add more advanced accounting features:

- Time tracking.

- Bill management.

- Inventory tracking.

- Real-time budgeting and cash flow forecasting.

- Employee expense tracking and reimbursement.

Pros and cons

| Pros | Cons |

|---|---|

|

|

QuickBooks Solopreneur: Best for solopreneurs filing itemized taxes

Our star rating: 3.8 out of 5

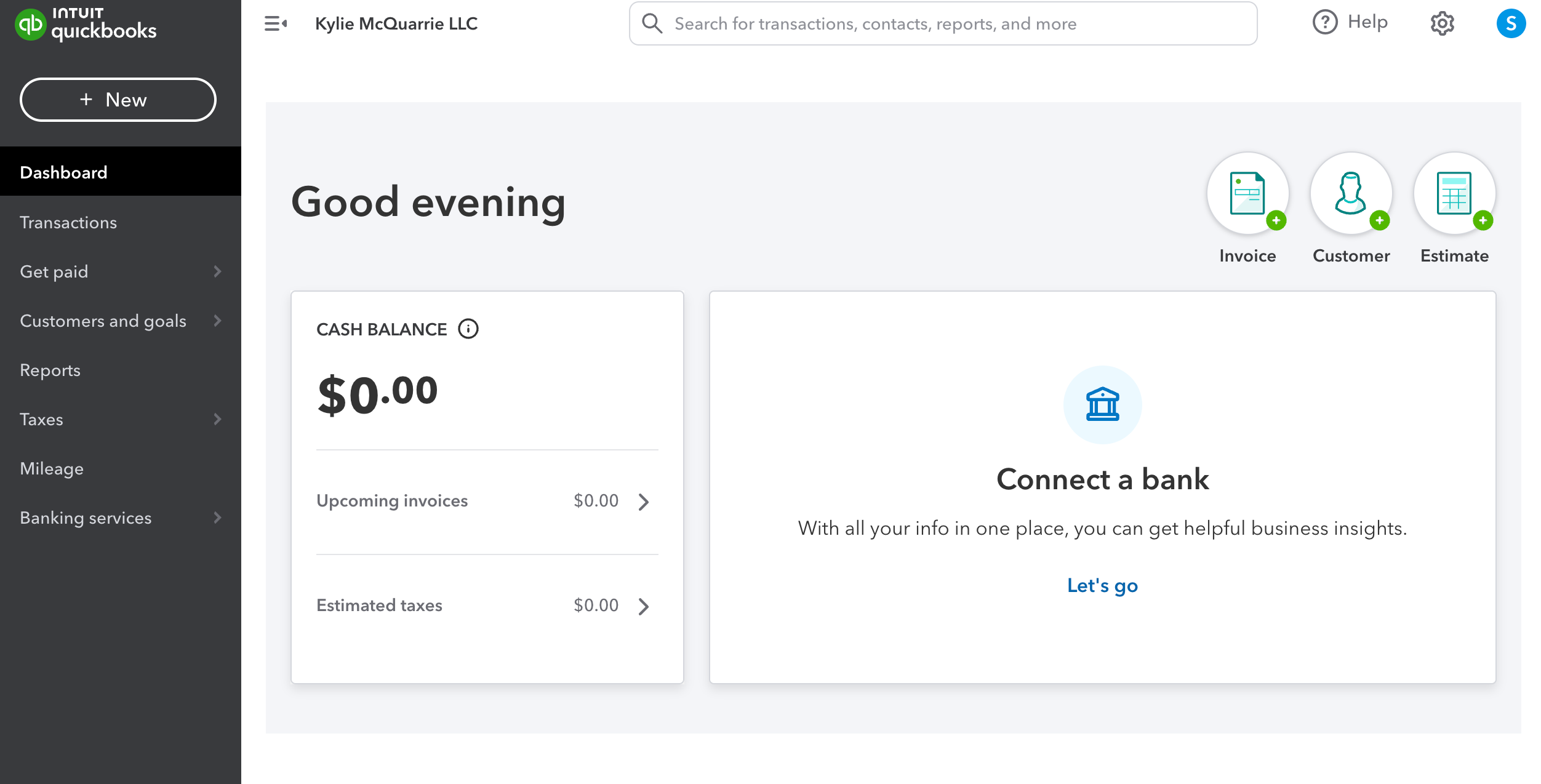

If you’re a freelancer in need of basic bookkeeping software only, QuickBooks Solopreneur could be a better choice for you than QuickBooks Online. With its limited set of features, QuickBooks Solopreneur helps individuals hone in on the most important aspects of growing a business, from setting financial goals to correctly categorizing expenses for tax time.

QuickBooks Solopreneur is most useful for freelancers filing Schedule C with their end-of-year taxes. Using the Solopreneur app, you can automatically log mileage in an IRS-friendly format for easier itemization come tax time.

However, if you’re looking for anything beyond the basics, I recommend QuickBooks Online over QuickBooks Solopreneur. For just $10 more a month, you get a far more expansive set of features, a more robust mobile app and the option to disregard any accounting tools (like a chart of accounts) that your business doesn’t need — yet.

Pricing

QuickBooks Solopreneur costs $20 per month. If you waive your free trial and choose to take 50% off for three months, you’ll pay just $10 a month for three months. Alternatively, you can pay yearly, which gets you 50% off for your first year of service ($120 total).

Features

- Basic cash flow tracking.

- Financial goal creation and tracking.

- App-based mileage tracking.

- Sales and sales tax tracking.

- Unlimited customizable invoices and estimates.

Users can also choose to open a QuickBooks Checking account to manage their business finances (alternatively, you can connect a pre-existing business bank account for automated profit tracking).

Pros and cons

| Pros | Cons |

|---|---|

|

|

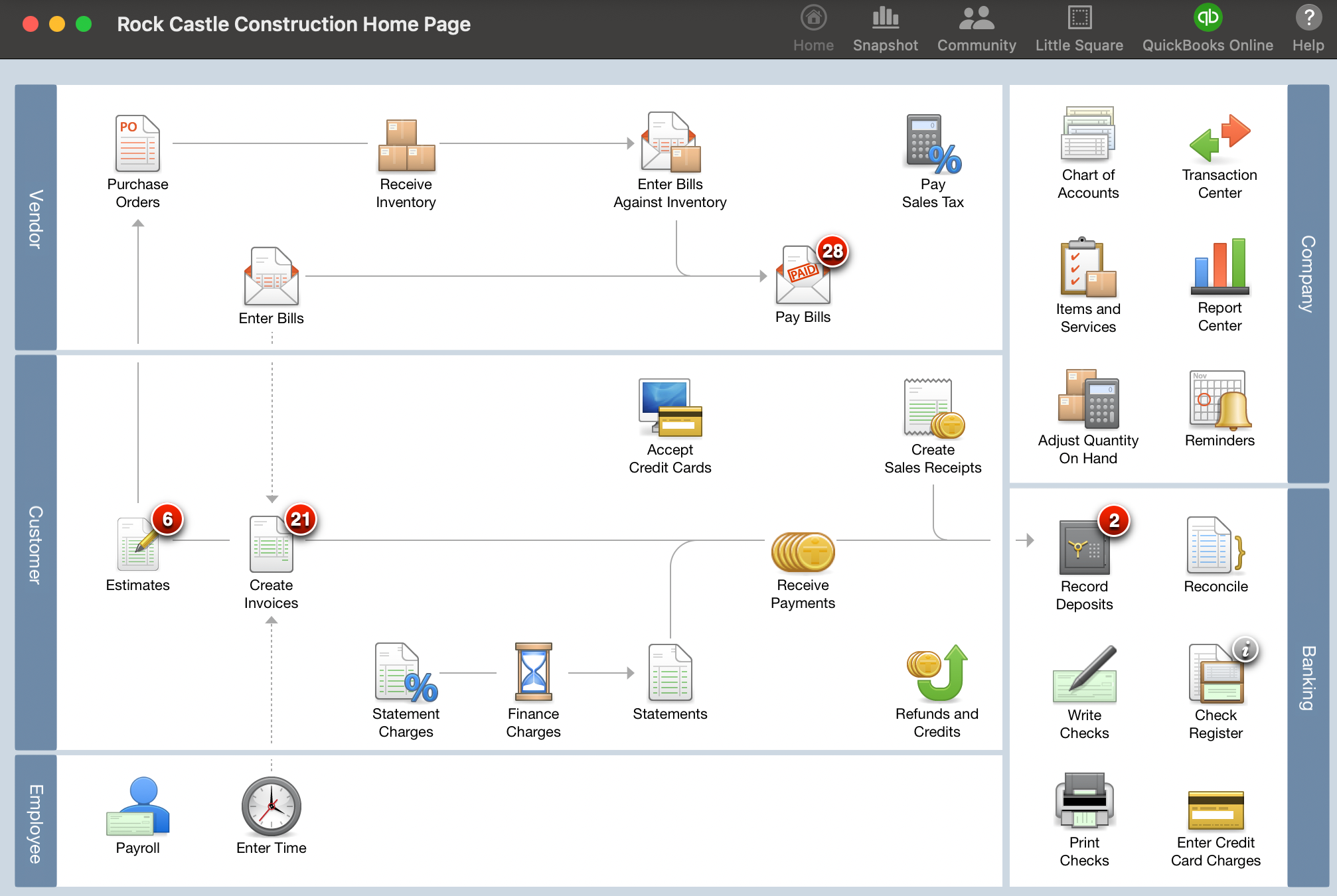

QuickBooks Enterprise: Best for enterprises with complex finances

Our star rating: 4.5 out of 5

QuickBooks Enterprise is a robust, desktop-based version of QuickBooks’ accounting software. It features a far more extensive suite of tools than any other QuickBooks accounting product, plus stand-out perks like access for up to 40 users and optional industry-specific software packages.

From July 31, 2024 onward, QuickBooks Enterprise will be Intuit’s sole desktop-based accounting software product. Although it’s eliminating other desktop software, QuickBooks has no plans to scrap QuickBooks Enterprise: It’s one of the most widely used, well-respected and longstanding products in the accounting software field.

In other words, you don’t need to worry about suddenly losing product support if you choose QuickBooks Enterprise. The product is a top choice for accounting firms and enterprises in industries across the world, so it should be here to stay.

For more information, read our full QuickBooks Enterprise review.

Pricing

QuickBooks sells three different versions of its Enterprise desktop software. All three software options require an annual subscription:

- QuickBooks Enterprise Gold: Starts at $1,922 for one year.

- QuickBooks Enterprise Platinum: Starts at $2,363 for one year.

- QuickBooks Enterprise Diamond: Starts at $4,668 for one year.

After one year, the pricing for your Enterprise subscription increases. You’ll also pay an extra fee for features like cloud access, online data storage and priority customer service.

Features

All three enterprise-level plans include industry-standard accounting features, from expansive industry-specific reports to online payment acceptance.

Along with standard accounting tools, QuickBooks Enterprise users can expect the following:

- Integration with over 200 third-party apps.

- Inventory management.

- Built-in payroll.

- Industry-specific accounting packages.

Pros and cons

| Pros | Cons |

|---|---|

|

|

QuickBooks Payroll: Best payroll option for QuickBooks Online users

Our star rating: 4.1 out of 5

QuickBooks Payroll is Intuit’s cloud-based payroll software product, and it primarily supports QuickBooks Online users with employees. It isn’t the most comprehensive payroll solution on the market — for instance, it lacks the more complex HR features you’d get from a combined HR/payroll software provider like ADP or Paychex.

However, if you’re familiar with QuickBooks’ interface, recently hired your first employee and want to start running payroll as painlessly as possible, QuickBooks Payroll is the simplest solution.

For more information, read our full QuickBooks Payroll review.

Pricing

QuickBooks Payroll offers three basic plans, each with a different base price and per-payee fee:

- QuickBooks Payroll Core: $45 per month plus $6 per employee paid per month.

- QuickBooks Payroll Premium: $80 per month plus $8 per employee paid per month.

- QuickBooks Payroll Elite: $125 per month plus $10 per employee paid per month.

As with other QuickBooks products, users can choose to try QuickBooks Payroll free for 30 days or get 50% off the base price for three months.

Features

All three QuickBooks Payroll plans share the same basic features:

- Full-service payroll in all 50 states.

- Unlimited payroll runs.

- Optional employee benefits, including medical, dental and vision insurance and retirement plans.

- Optional workers’ compensation insurance integration.

The two higher-tier payroll plans include expanded features, such as the following:

- Built-in time tracking with QuickBooks Time.

- Same-day (rather than next-day) direct deposit.

- Access to an HR support center (Premium) or personal HR advisor (Elite).

- Additional customizations, automations and scheduling features.

Pros and cons

| Pros | Cons |

|---|---|

|

|

QuickBooks Live Bookkeeping: Best on-demand bookkeeping service for QuickBooks users

Our star rating: 4.6 out of 5

If you don’t want to handle bookkeeping entirely on your own but don’t have the funds to pay for an in-house accountant or in-person bookkeeping services, QuickBooks’ virtual bookkeeping service is a smart choice.

With QuickBooks Live Bookkeeping, business owners tracking their finances with QuickBooks Online can quickly, easily get virtual bookkeeping help from financial professionals. After an initial setup where your QuickBooks-certified bookkeeper reviews your financial records from the previous year and gets your books in order, they’ll be available to tackle basic bookkeeping tasks month over month while you focus on other aspects of running a business.

Pricing

Monthly pricing for QuickBooks Live Bookkeeping varies based on your average monthly expenses:

- If your average monthly expenses range up to $10,000, you’ll pay $300 per month for QuickBooks Live.

- If your average monthly expenses range from $10,001 to $50,000, you’ll pay $500 per month for QuickBooks Live.

- If your average monthly expenses are at or above $50,001, you’ll pay $700 per month for QuickBooks Live.

Additionally, you’ll pay a one-time “cleanup” fee to get your books in order the first time you sign up for QuickBooks Live Bookkeeping. The cleanup fee is custom and can vary based on your business’s age, tax-filing status and service signup month.

Features

No matter what you’re charged for your QuickBooks Live Bookkeeping subscription, you’ll get access to the same set of services provided by your QuickBooks-certified virtual bookkeeper:

- Basic introduction to QuickBooks Online.

- Customer and vendor setup within QuickBooks.

- Chart of accounts setup.

- Expense categorization.

- Bank connections and bank reconciliation.

- Ongoing help with common bookkeeping questions and concerns.

QuickBooks Live doesn’t offer any tax services, including tax preparation assistance, so you’ll need to work with your own accountant or another tax professional to file taxes at the end of the year.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Which Intuit QuickBooks accounting software product is right for my business?

For most non-enterprise U.S.-based businesses, QuickBooks Online is the best Intuit accounting product. As a cloud-based solution, it’s flexible, accessible and extremely approachable for non-accountant business owners. And with four plans, QuickBooks Online gives growing businesses room to expand into more complex plans with advanced accounting features.

But QuickBooks Online isn’t the right match for every business owner. If you’re not interested in QuickBooks Online, we recommend the following Intuit accounting products:

- Choose QuickBooks Solopreneur if you’re a sole proprietor of a brand-new business with fairly straightforward finances.

- Choose QuickBooks Enterprise if you’re part of an enterprise or large corporation with advanced accounting needs.

- Choose QuickBooks Live Bookkeeping to supplement your QuickBooks accounting software if you want to outsource most bookkeeping tasks to a trustworthy service.

If Intuit QuickBooks doesn’t offer any products that appeal to you, there are dozens of other accounting services that could meet your needs instead. Find a good fit by reading our list of the year’s best accounting software and services.

Finally, don’t forget that most accounting companies offer free trials (or, at the very least, free demos), Intuit QuickBooks included. Signing up for a free trial — whether with QuickBooks Online or one of its top accounting competitors — and testing the software yourself is the best way to find the right accounting software service for your business.

Methodology

To review and compare each QuickBooks product as thoroughly as possible, I took advantage of free trials, virtual demos and information provided directly by members of the QuickBooks team. I also read a variety of verified user reviews on sites like Gartner Peer Insights, the Better Business Bureau, the App Store and Google Play (among others) to ensure my viewpoint and hands-on experience weren’t the only ones represented in the review.

I also use an in-house algorithm and scoring rubric to generate star ratings for each brand (and in this case, each standalone product) I review. Here’s a quick summary of how we score the products we review:

- Pricing (weighted to 25% of the total star rating). Scoring criteria include lowest- and highest-tier plan prices, fees for essential features, free trials and more.

- Accounting features (weighted to 30% of the total star rating). Scoring criteria include access to basic and advanced accounting features with each plan.

- Ease of use (weighted to 15% of the total star rating). Scoring criteria include mobile app access and reviews, customizability, native third-party app integration, user-friendliness, interface design and more.

- Customer service (weighted to 15% of the total star rating). Scoring criteria include modes of customer service access, hours of availability, response time, legal complaints against the business (if any) and more.

My own experience testing and reviewing the software — including criteria like how easy it was to research software specifics and whether or not I was able to test the software firsthand — comprises the final 10% of our star rating.

Frequently asked questions

What are the different types of products in QuickBooks?

QuickBooks offers a variety of accounting, payroll, bookkeeping and other business products. QuickBooks Online is its most popular cloud-based accounting product while QuickBooks Enterprise is its flagship desktop-based accounting product.

QuickBooks’ other accounting software product, QuickBooks Solopreneur, is a bare-bones tool well-suited to single-owner businesses that want basic accounting help only.

Apart from its accounting software products, QuickBooks sells the following business software tools:

- QuickBooks Payroll and QuickBooks Contractor Payments for payroll management.

- QuickBooks Time for managing time, attendance and scheduling.

- QuickBooks Money, a subscription-based banking and payments solution.

- QuickBooks Live Bookkeeping, a virtual bookkeeping service offered through QuickBooks Online with QuickBooks-certified bookkeepers.

- QuickBooks Payments, an online payment acceptance tool.

Is QuickBooks phasing out QuickBooks Desktop?

QuickBooks will stop new sales of most of its desktop-based programs in the United States on July 31, 2024. While existing annual subscribers will be able to renew their subscriptions and enjoy ongoing support, new subscriptions of QuickBooks Desktop Pro, Premier, Enhanced Payroll and Mac will no longer be available.

If you want non-enterprise desktop software from QuickBooks, you’ll need to purchase the product on or before July 31, 2024. After that point, new sales will end, but existing customers will retain access to their software program.

However, QuickBooks has no plans to phase out QuickBooks Desktop Enterprise. Additionally, customers in regions outside of the U.S. should be able to access their region’s desktop-based QuickBooks software for the foreseeable future.

If you’re looking for non-QuickBooks desktop-based software, we recommend the desktop-based Sage 50 Accounting for midsize and large businesses.

Source of Article